Nomura is a financial services group with an integrated global network. By connecting markets East & West, we service the needs of individuals, institutions, corporates and governments through our four business divisions: Wealth Management, Investment Management, Wholesale (Global Markets and Investment Banking) and Banking.

Driven by the insights of some 26,000 people worldwide, we put our clients at the center of everything we do, delivering unparalleled access to, from and within Asia.

27,876

Our diverse talent pool and wide range of values are the source of our competitive strengths.

Servicing our clients for more than 90 years since

1925

Wealth Management client assets exceeding

162.3trillion

A diverse workforce with approximately

90nationalities

Extensive retail

network in Japan with

104branches

(As of April 1, 2025)

Coverage of global economic & financial indicators

(handled by our global research team)

86%

101.2trillion

Net assets under management through our investment trust and investment advisory businesses

<Education>1,175,000 (As of March 2025)

Elementary school, high school & university students have attended our lectures on finance & economics

As of September 2025

Clients at the Center of Everything We Do

Our priority is to customize solutions that align with clients' strategic interests.

We believe in long-term partnerships created uniquely for each client.

Long History in Asia

Our experience navigating Asia's cultures and customs is unrivaled.

We are deeply rooted in Asia with a global footprint, enabling us to operate seamlessly across borders.

Integrated Global Access

With access to over 30 countries and a presence on major stock exchanges, we connect you to markets East and West.

Disciplined Entrepreneurship

We seek creative solutions for clients with an acute understanding of the risks involved.

Our clients are equipped with a diverse and nimble portfolio placing them well ahead of the market.

The Wealth Management Division offers comprehensive wealth management services catering to the diverse needs of individual and corporate clients through our nationwide network of branches, as well as our digital services. In addition to traditional investment products such as stocks and bonds, our proactive team of professionals provides tailor-made consulting services to help our clients achieve the future they envision, including estate planning, real estate, asset succession and M&A services.

Investment Management leverages the know-how and expertise of the entire group to deliver added value for our clients. We offer investment solutions across a wide range of asset classes, from traditional assets such as stocks and bonds to alternative assets such as private equity, to meet the diverse needs of our clients.

By enhancing the asset management business and expanding investment capabilities, we strive to achieve organic/inorganic growth.

Global Markets provides sales and trading services in bonds, equities, foreign exchange and derivatives for institutional investors globally. Investment Banking provides underwriting, advisory and risk solutions to corporates, financial institutions and public sector organizations around the world.

Banking Division will leverage the strengths of Nomura Trust and Banking Co., Ltd. and Nomura Bank (Luxembourg) S.A. in private markets and bespoke products and meet the diverse needs of clients in areas such as asset building and estate planning.

Serving Our Clients

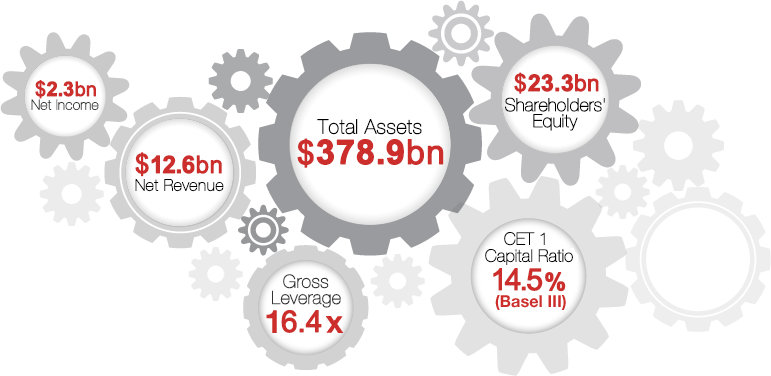

As of March 2025 (1USD = 149.90JPY)

As of September 2025

2,400

Our Wholesale operation services local clients through 15 locations in the Americas, which represents the largest fee pool in global investment banking. Nomura also operates a boutique investment management firm specializing in high-yield investments.

3,100

Headquartered in London with operations in 13 countries, our EMEA business has over 60 years of experience connecting markets East and West. We provide a wide range of solutions across Global Markets and Investment Banking to our corporate, institutional, government and public sector clients.

7,100

Building on the presence we have established across 15 cities, we are laying the foundation to further expand our retail, wealth management and asset management capabilities in the Asia region where we see long-term economic growth.

15,100

In addition to managing 173 trillion wealth management client assets and 15% of securities accounts in Japan, we are the country’s largest asset manager by assets under management. We also provide a broad range of sales and trading as well as underwriting and advisory services to our clients in Wholesale.