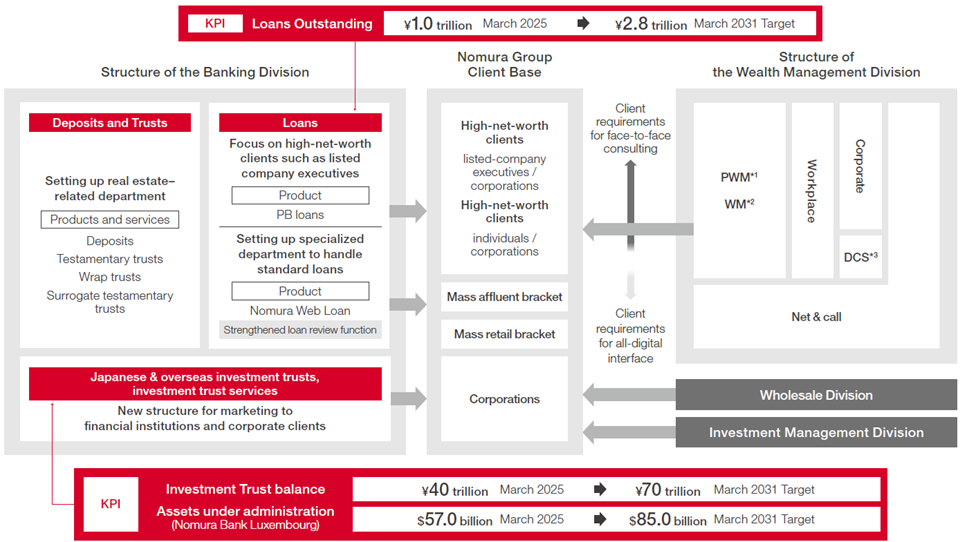

The Banking Division has established a strategy to expand business while taking appropriate risks in areas adjacent to financial capital markets where Nomura Group has core strengths. Specifically, we are advancing initiatives across three key perspectives, access to clients, products and services, and systems. The division aims to achieve income before income taxes of 50 billion yen for FY2030/31, approximately 3 times the 16.4 billion yen recorded in FY2024/25. The division has set KPI targets to build up loan balances to 2.8 trillion yen, investment trust balances to 70 trillion yen, and NBL’s assets under administration to 85.0 billion dollars by the end of March 2031.

To strengthen relationships with clients upon establishing the Banking Division, we reorganized the structure and streamlined products and services in alignment with the client segments of the Wealth Management Division, the Wholesale Division, and the Investment Management Division.

In the area adjacent to the financial capital market—Nomura Group’s core strength—we will focus on developing products and services based on client demand.

Building a structure organized by product, service, and client segment

*1 PWM: Private Wealth Management

*2 WM: Wealth Management

*3 DCS: Digital Customer Service

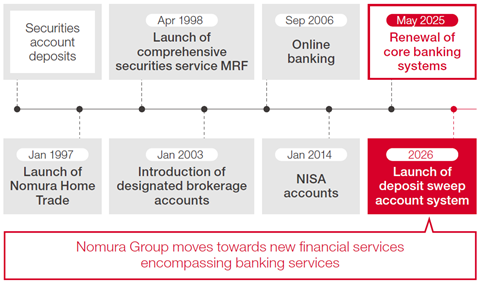

NTB implemented a core accounting system renewal in May 2025 for the first time in approximately 20 years, enhancing and expanding the bank’s foundational systems. This has created the infrastructure for a deposit sweep service that allows automatic fund transfers between accounts held by clients at both Nomura Securities and NTB. The deposit sweep service is scheduled to launch in FY2026/27. Going forward, offering financial hybrid services that add banking functions to Nomura Securities accounts will improve client convenience.

At NTB, we have recently reorganized our structure and streamlined products and services to align with the client segments of the Wealth Management Division. For listed company owners and corporate clients who have strong needs for face-to-face consulting, a dedicated department provides full support using various services and functions such as PB loans*1, deposits, and trusts.

For high-net-worth clients with increasing demand for online transactions, a dedicated department handling online loans (Nomura Web Loan) responds to client needs by leveraging digital tools. By clarifying the roles of each department and reorganizing the supporting organizations, we have accelerated sales promotion and enhanced operational efficiency including strengthening compliance measures and management capabilities.

Additionally, to increase client access through the development of new products and services, we have established a department focused on real estate businesses. To strengthen the system responding to expanding businesses such as asset management trusts, we also recently established a department to handle financial institutions and various corporations.

At NBL, we have expanded the investment trust services of overseas investment trusts, primarily targeting Japanese institutional investors and high-net-worth individuals. Our product lineup includes foreign currency MMFs and monthly distribution-type investment trusts. In response to the recent growing interest in private assets, we will further strengthen investment trust-related services focused on private asset investing.

*1 PB loans stand for Private Banking loans

NTBs is enhancing its PB loan business, through expanding collateral options and acquisition processes to enhance client convenience. For Nomura Web Loan, we have expanded the types of securities eligible as collateral and increased borrowing limits. Going forward, in addition to expanding collateral options, we will expand workplace loans by providing funding for stock option exercises and tax payments through RS/SO loans*2.

In the trust services, we will continue to focus on administering investment trusts, developing trust schemes to support operating company’s needs, and enable regional financial institutions to invest in private assets by expanding the lineup of services that use trust schemes such as fund trusts (designated unit trusts).

For high-net-worth clients, we will provide trusts related to succession services, including testamentary substitute trusts and donation trusts, as well as real estate related services.

At NBL, we will expand fund administration services centered on private assets, which are experiencing growing demand from both institutional investors and high-net-worth clients requiring customized services.

Going forward, we will evaluate our client needs, and continue to refine and develop new products and services in the “areas adjacent to the financial capital market,” which is the core strength of the Nomura Group.

*2 RS/SO stands for Restricted Stock and Stock Option. Restricted Stock refers to shares granted as part of stock-based compensation, which are subject to transfer (sale) restrictions until certain conditions are met, such as continuous employment for a specified period. Stock Options are rights that allow the holder to purchase company stock at a pre-established price.

Since 1997, when Nomura Securities introduced Nomura Home Trade, and later in 2006 when NTB launched its internet banking service, the Nomura Group has been committed to enhancing client convenience through its systems.

Changes in client accounts over the years

In May 2025, a significant project—to upgrade NTB’s core banking system— was completed, enabling an expansion of system capacity. By the FY2026/27, the Group plans to start offering a deposit sweep service that allows automatic fund transfers between Nomura Securities’ securities accounts and NTB’s bank accounts. This will be considered a financial hybrid service that adds banking functions to Nomura Securities accounts, greatly improving client convenience.

Moreover, through various system enhancement initiatives, we are working to develop and strengthen our business platform. In the medium- to long-term, we plan to extend the platform functions of the Banking Division to clients beyond the Nomura Group.