Investment Management Division aims to provide high quality, high value-added investment products and services and increase awareness both domestically and internationally. We will achieve this goal through growing assets under management and expanding high value-added businesses connected to the following three themes: “Solutions capturing opportunities in Japan,” “Global value creation,” “New growth in collaboration with global stakeholders.”

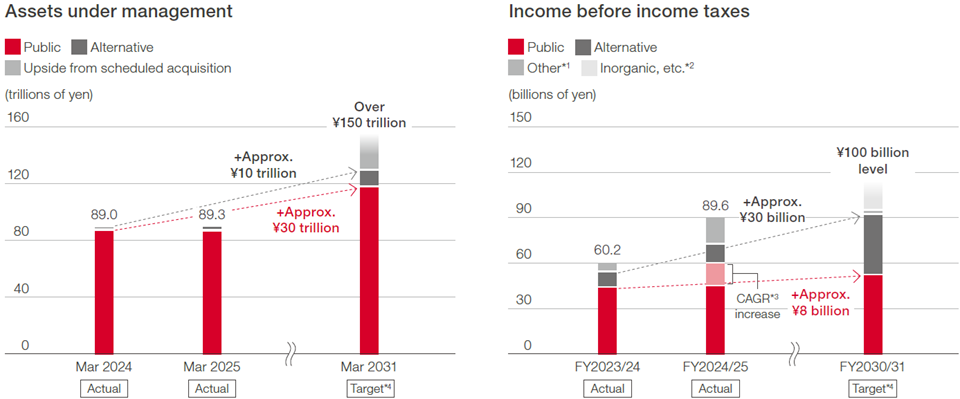

As of the FY2024/25, assets under management exceeded the KPI target of 89 trillion yen, and income before income taxes reached highest levels since the division was established in April 2021. Inflows to high value-added areas such as active management and private asset products for high-net-worth clients drove changes in product mix and improved our management fee ratio.

Looking ahead to the FY2030/31, we aim to grow assets under management to over 150 trillion yen and achieve income before income taxes of 100 billion yen, including public, alternative, and the U.S. and European asset management businesses we will acquire from the Macquarie Group. Our key focus areas going forward are: “Solutions capturing opportunities in Japan,” “Expanding private and real assets” and “Establishing a global platform through the acquisition of Macquarie’s U.S. and European public asset management business.”

As the Japanese economy emerges from deflation, there is a growing demand for stock and mutual fund investment management from the perspective of preserving purchasing power. The re-evaluation of Japanese equities, driven by the structural improvement in the profitability of Japanese companies, has also prompted changes in investor behavior. Under the “Policy Plan for Promoting Japan as a Leading Asset Management Center” by the Japanese government, the asset management business is entering a period of remarkable growth.

In response to global inflation, a higher interest rate environment, and increasing financial regulations, there is a growing investor demand for stable income generation aimed at hedging against inflation and risk diversification. Accordingly, alternative investments offering significant diversification benefits and potential for higher returns are attracting attention. In Japan, where the proportion of alternative investment is relatively low, substantial growth is expected going forward. Encouraged by the establishment of regulatory frameworks, access to private assets for high-net-worth clients is also expanding, broadening the investor base. Real assets such as real estate, infrastructure, and forestry, which have strong inflation protection, are gaining attention as stable sources of income.

Through the acquisition of Macquarie Group’s business, we will expand our presence in the U.S., enable us to scale our franchise globally and establish ourselves as a significant global asset manager.

*1 Other includes American Century Investments related gain/loss and other gains/losses.

*2 Includes income before income taxes targets stemming from acquisition of Macquarie’s U.S. and European public asset management business announced in April 2025.

*3 CAGR for FY2023/24 through FY2030/31.

*4 Upside other than from scheduled acquisition based on figures announced at May 2024 Investor Day.

We provide solutions that address the needs of the retirement generation by balancing needs for asset management and asset utilization. By strengthening collaboration within the Nomura Group on DC pension plans, we support asset building aligned to clients’ life cycles.

We offer customized solutions for high-net-worth clients and corporations that combine a wide range of asset classes from traditional assets to private assets. We are strengthening the Chief Investment Office (CIO)*1 functions responsible for “asset allocation” and “fund selection” to support discretionary and advisory services provided by the Wealth Management Division. Leveraging over 20 years of experience in evaluating and managing alternative assets, we will further promote the “democratization of private investment” and enable individual investors to invest in private assets that were previously accessible only to limited institutional investors, through Nomura Alternative Connect (NAC)*2.

Investors’ holdings of ETFs have been increasing year over year, and there is still potential for further expansion as an investment vehicle, especially in Japan. We will further expand our product lineup and strengthen our marketing strategy to institutional and individual investors.

In Japan, we are engaged in buyout investments, search funds (business succession buyouts), growth investments, and mezzanine investments. Going forward, we will continue to strengthen collaboration within the Group and further scale our franchise through launching successor funds.

In the United States, we are building and expanding our private credit investment platform. We manage funds that use secured loans backed by real estate and other assets, as well as direct lending to companies, offering differentiated and risk-diversified investment opportunities.

In the real asset domain, we have expanded beyond our established aircraft leasing business and into real estate and forestry assets. Through further leveraging the Group’s comprehensive strengths, including human resources and client networks, we aim to expand our product offerings.

Globally, we are developing high-quality investment products that promote a virtuous cycle of investments aimed at addressing social issues. Currently, we are expanding into new areas such as farmland, renewable energy, and energy storage.

In April 2025, we agreed to acquire three companies from Macquarie Group in a 100% stock purchase transaction. This acquisition will increase the total assets under management in the Investment Management Division from 16%*3 to 35%*4 managed on behalf of clients outside Japan, and the overseas revenue ratio from 34% to 60%. This acquisition will also provide Nomura with scaled business capabilities and a client base to further grow its international Investment Management business. Following completion, we will focus on enhancing our presence in the U.S. The acquired business*5 maintains relationships with nine of the top ten retail distribution platforms in the U.S., leveraging this advantage to maintain and expand its client base. Simultaneously, we will accelerate growth and build new investment capabilities. Utilizing the acquired platform, we plan to promote further growth of existing businesses, such as offering Nomura Group’s private credit funds to clients through the acquired business’s distribution channels. Additionally, this acquisition will facilitate collaboration whereby Nomura Group will act as a U.S. distribution partner for Macquarie Group’s alternative products targeting high-net-worth clients. Ultimately, by combining our strengths, we aim to expand our client base and investment capabilities globally, including in Asia and Europe.

*1 CIO Services involves using Nomura’s highly value added advisory models with the goal of “Extending our asset management services usually provided for institutional investors such as public and corporate pension funds to retail investors”.

*2 Nomura Alternative Connect (NAC) is a service that provides access to global alternative investment products. By creating a one-stop solution to access global alternative products, it enables clients to receive advice on various asset classes, regions, investment strategies, risk preferences,

and investment formats, allowing them to construct diversified portfolios.

*3 As of the end of December 2024.

*4 Net Management Fees and AuM: represent unaudited indicative

September 2024 figures (annualized for Net Management Fees) for the entire business to be acquired. Rounded figures by the Investment Management planning department of Nomura Holdings, Inc as of December 2024.

*5 Asset management business focused on active investment of traditional assets