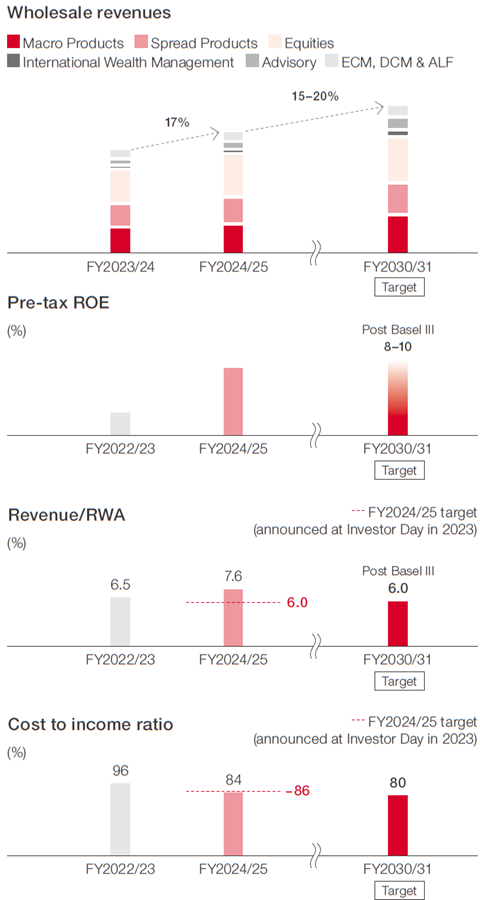

Wholesale achieved its highest profit in 15 years in FY2024/25, with an income before income taxes of 166.3 billion yen on a net revenue of 1,057.9 billion yen that is 22% higher year on year, resulting in a resource efficiency of 7.6%. We continued to make solid progress in creating a more stable and scalable platform, delivering balanced growth across businesses and expanding our client franchise. By deepening our client relationships and cross-sell, we have increased client revenues in Global Markets (+25% vs FY2022/23) and Investment Banking (+39% vs FY2022/23) along with higher multi-product traction*1 (+8% vs FY2022/23). All our global businesses are on a solid growth trajectory and contributing to build a diversified franchise that can deliver through the cycle performance.

Through our targeted strategy, we have strengthened our revenue streams and improved profitability by reallocating resources to invest in opportunities that deliver higher returns. Specifically, our continuous investment in talent, including senior leadership roles, is now contributing to enhanced productivity. For instance, our International overall Investment Banking Managing Director productivity*2 increased by more than 30% in FY2024/25 vs FY2022/23 and in Global Markets overall productivity increased by approximately 20% as we increased revenue while keeping our headcount relatively flat. These gains, combined with our disciplined cost management, have contributed to a reduction in cost-to-income ratio from 96% in FY2022/23 to 84% in FY2024/25.

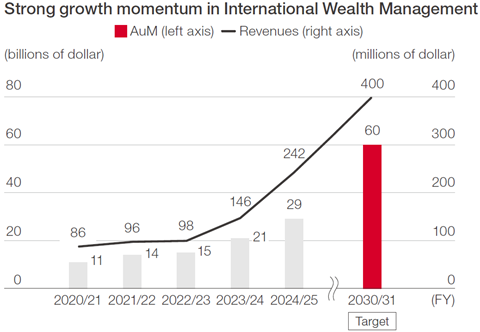

We also witnessed continued momentum in our International Wealth Management business, where AuM reached 29 billion U.S. dollar (up approximately 95% vs FY2022/23 and nearly 4x since the buildout started in 2020). Building a diversified business, combined with robust risk management enhanced the overall stability of our platform and reduced volatility of earnings by 20 points*3.

Wholesale will continue to maintain this momentum as we chart our course for 2030. We expect the platform to grow by another 15-20% by 2030 driven by broad based expansion across all asset classes. Building on this strong foundation, we will further deepen our client relationships and increase wallet share. We aim to make steady gains in our market share through strategically expanding key businesses in Spread Products, Equities and Advisory, while further strengthening our historically strong global Macro Products and Japan businesses. We will deepen client penetration through enhanced cross-sell and collaboration across divisions, products, and regions.

In conjunction with our growth plans, we will further enhance our platform efficiency with a focus on robust risk management and through proactive management of our fixed cost base. Additionally, we will continue to diversify the business by expanding our International Wealth Management franchise in Asia and in select new markets like Middle East.

Through this approach, our strategy remains focused on building a balanced, resilient platform that can navigate volatility, and deliver sustainable profitability. As a result of these strategic initiatives, Wholesale targets 8-10%*4 pre-tax ROE, approximately 6%*4 resource efficiency, and 80% cost-to-income ratio for FY2030/31.

*1 Multi-product traction refers to revenues booked in the last 12 months with clients who have two or more fee events in last 60 months.

*2 Producer headcount with time in title more than 1 year, excl. Japan expats

*3 FY2024/25 vs FY2022/23. Volatility measured as coefficient of variation, defined as standard deviation/mean of daily revenues

*4 Post Basel III

In Wholesale, we are focused on generating sustainable long-term returns across market cycles, and we aim to achieve through-the-cycle pre-tax ROE of 8-10% on a post Basel III basis.

Firstly, delivering steady and sustainable earnings continues to be a key pillar of focus for Wholesale. Building a balanced portfolio across Macro Products, Spread Products, Equities, Investment Banking and International Wealth Management will help us enhance revenue stability and address market cyclicality. Additionally, we aim to further reduce volatility in our earnings by enhancing risk management frameworks, implementing robust trading oversight, and conducting comprehensive stress testing across businesses.

Second, we will drive cost efficiency through comprehensive reviews of our cost base. We are focusing on optimizing our corporate cost base through Group Structural Reform initiatives such as the standardization of our IT architecture, location strategy, and streamlining of our organizational structure. We are reinvesting part of these savings into growth initiatives while progressing toward our FY2030/31 cost-to-income ratio target of approximately 80%.

Finally, we aim to become self-sufficient and grow via self-funding and re-investing a portion of the earnings generated by the division back into the business. We will further enhance resource efficiency and scalability through targeted investments and external partnerships. Wholesale aims for approximately 6% resource efficiency post-Basel III through FY2030/31.

Growth strategy for Wholesale emphasizes balanced growth across trading, financing, structuring/solutions, advisory, and fee-based businesses, enabling consistent performance across market cycles.

We are bolstering our core strengths globally, including our market leadership in Japan while enhancing talent productivity across all businesses. We have strategic growth plans in place to expand in businesses such as Private Credit, Structuring/Solutions businesses, EMEA and AEJ Equities, International Wealth Management, and US Investment Banking. At the same time, we will capitalize on opportunities in Macro businesses amidst the evolving market environment.

Specifically, within Global Markets, we continue to leverage our product expertise from one region to expand into other regions. The successful build-out of Equities and Securitized Products in EMEA and AEJ is now contributing to the regions’ earnings growth.

In Investment Banking, we will continue building on our dominant position in Japan and will drive growth through further product diversification. In International regions, we are focused on building scale and diversifying in regions as well as driving efficiencies across the platform to enable productivity growth. We have embraced the shift towards Advisory, while maintaining our focus on Capital Markets and Solutions to drive origination and cross-sell.

To accelerate the growth of our client franchise, we are investing in expanding across emerging client segments; while intensifying cross-divisional collaboration and cross-sell initiatives aimed at capturing greater wallet share on back of an integrated global offering.

We will accelerate the implementation of Gen AI capabilities to further enhance productivity across our businesses and improve the overall efficiency of the platform.

We are focused on diversifying the Wholesale business mix across products, clients and markets. Following the success in our International Wealth Management business, a key part of our diversification strategy, we aim to become a top 15 wealth manager in AEJ by FY2030/31. To achieve this, we are maintaining strong momentum across North, South and Southeast Asia, while pursuing expansion in newer geographies like the Middle East.

We intend to further broaden our client base with increased focus on Corporate, Insurance, Pension, and Sponsor segments. Additionally, we will continue to pursue opportunities across emerging markets like India and Middle East with high growth potential.

Lastly, collaboration across businesses, regions and divisions remains a key enabler of our strategy to maximize our revenue potential. Wholesale is developing a strong ecosystem through synergies and partnerships to diversify sources of capital, enhance origination and expand lending capabilities.