-

PDF

(228KB)

PDF

(228KB)

BOOSTRY Co., Ltd.

BOOSTRY Co., Ltd. today announced that it has published the Japan Security Token Market Report for FY2024.

In FY2024, Japan's security token market continued to expand, although the total amount of public security token offerings (STO) was limited to approximately 47% compared to the previous fiscal year, largely influenced by widespread caution surrounding discussions on revisions to trust taxation. The cumulative issuance amount of public STOs increased, surpassing JPY160 billion.

With the tax revision discussions reaching a conclusion in 2024, FY2025 is expected to see a significant expansion in the issuance market, along with considerations for diversifying the underlying assets of securitized products.

In addition, ibet for Fin maintained its position as the leading blockchain platform supporting transactions and management of security tokens. The platform retained the highest share of public STO amounts for FY2024, continuing its momentum from the previous year.

Below is an overview of the report. The full report is available on "BOOSTRY BLOG."

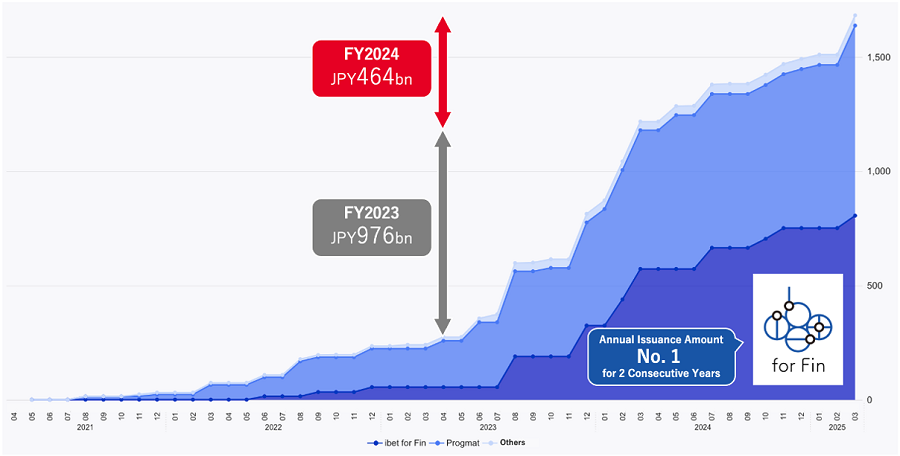

In FY2024, issuance amounts in the domestic public STO market1 totaled JPY46.4 billion, bringing the cumulative issuance amount to JPY168.2 billion. While the market saw steady growth, the FY2024 issuance amount was only about 47% of the JPY97.6 billion issued in FY2023.

This is likely attributable to the temporary suspension of STO issuances by many financial institutions to assess the operational and system impacts of tax reforms on beneficiary certificate issuance trusts, following a request for tax reforms in FY2025 issued by Japan's Financial Services Agency (FSA) in September 2024 to the Ministry of Finance for "clarification of tax implications following revisions to the Beneficiary Certificate Issuance Trust Calculation Rules by the Trust Association2." Following the publication of the "FY2025 Tax Reform Proposals3" in December 2024 providing clarity on policy direction, the issuance of real estate security tokens is expected to accelerate from FY2025. Additionally, discussions are expected to progress on new security tokens backed by moveable assets, made possible by the tax reforms.

- 拡大

- Figure 1: Trends in Public STO Issuance Amounts

The issuance market expects to see an acceleration of issuances by real estate companies that previously issued security tokens, the entry of real estate firms and companies from other industries, as well as the issuance of corporate bonds based on the START Market of the Osaka Digital Exchange (ODX).

Based on these factors, BOOSTRY forecasts total issuance of approximately JPY1.8 billion in FY2025. In the distribution market, beyond the utilization of the START Market by ODX, the company also anticipates expanded usage of the registered PTS (Proprietary Trading System) framework and greater adoption of securitized products using digital fixed dates. Globally, RWA (Real World Asset) tokenization of various rights, including non-securities, is progressing. The ibet for Fin platform, which is led by BOOSTRY, aims to develop further as a platform capable of handling these diverse rights.

- 1. Private placement projects with limited investors are excluded from the tally due to many issuance amounts remaining undisclosed.

-

2. https://www.mof.go.jp/tax_policy/tax_reform/outline/fy2025/request/fsa/07y_fsa_k_08.pdf

(118KB)

2. https://www.mof.go.jp/tax_policy/tax_reform/outline/fy2025/request/fsa/07y_fsa_k_08.pdf

(118KB)

- 3. https://www.mof.go.jp/tax_policy/tax_reform/outline/fy2025/07taikou_03.htm#03_04

Nomura

Nomura is a financial services group with an integrated global network. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its four business divisions: Wealth Management, Investment Management, Wholesale (Global Markets and Investment Banking), and Banking. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.