-

PDF

(132KB)

PDF

(132KB)

Nomura Holdings, Inc.

Tokyo, March 29, 2024—Nomura Holdings, Inc. (“NHI”) hereby announces that it has decided, at a meeting of the Compensation Committee held on March 29th, 2024, to introduce performance-based share units (Performance Share Unit: PSUs) as a long-term incentive plan. The purpose of introducing PSUs is to enhance NHI’s corporate value over the medium to long term and strengthen alignment of interests with shareholders.

Under NHI’s PSU program, the base number of shares to be granted is initially determined based on NHI’s performance and other factors each fiscal year. Following the performance period, the number of shares to be awarded will vary from 0% to 150% of the base number of shares depending on the degree of achievement of the performance targets for the three fiscal years. The settlement of the PSUs will be primarily in treasury stock.

The performance indicators used in the evaluation are Return on Equity (“ROE”) and Total Shareholder Return (“TSR”). Please refer to the following for details.

In order to enhance NHI’s corporate value over the medium to long term and to align NHI’s interests with those of its shareholders, a combination of ROE (average value over the performance evaluation period) and TSR (absolute value over the performance evaluation period) will be the basis to calculate the award amount.

1. Calculation method for the base number of shares:

The base number of shares shall be calculated by dividing the amount determined with reference to the performance and qualitative evaluation of the target fiscal year, as well as competitor benchmarking by the price of NHI common stock at the time of grant.

2. Calculation method for the number of shares to be granted:

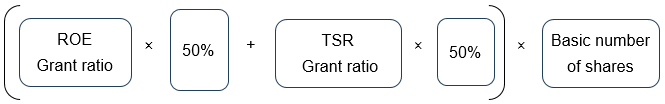

After the end of the performance evaluation period, the number of shares to be granted will be calculated in accordance with the following method.

(1) Quantitative Evaluation Items and Grant Ratio

| Performance Indicators | Composition ratio | Change in the grant ratio | Evaluation method |

|---|---|---|---|

| ROE | 50% | 0%~150% | Calculated based on the actual (average) values for the three-year performance evaluation period |

| TSR | 50% | 0%~150% | Calculated based on the actual value (absolute value) during the three-year performance evaluation period |

(2) Calculation method for the number of shares to be paid:

The number of shares to be granted is calculated by multiplying the base number of shares by the weighted average of the grant ratio based on ROE and the grant ratio based on TSR.

(3) Performance evaluation period and payment schedule:

The performance evaluation period shall be three years from the fiscal year following the fiscal year in which the base number of PSUs is determined. After the performance evaluation period has concluded, the evaluation shall be finalized and the stock compensation based on PSUs shall be paid.

The shares awarded at the end of the performance period will be primarily issued from treasury stock.

Nomura

Nomura is a global financial services group with an integrated network spanning approximately 30 countries and regions. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Investment Management, and Wholesale (Global Markets and Investment Banking). Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.