By using the CIO model to offer more sophisticated asset management advice and by providing a multi-track fee structure, we will deliver the best services that meet the needs and concerns of each client. Furthermore, we will strengthen our contact centers and other remote approaches to increase contact with clients. The expansion of our business for high net worth clients overseas will be promoted. We will also work with regional financial institutions to provide our consulting services to as many clients as possible in an effort to expand our client base.

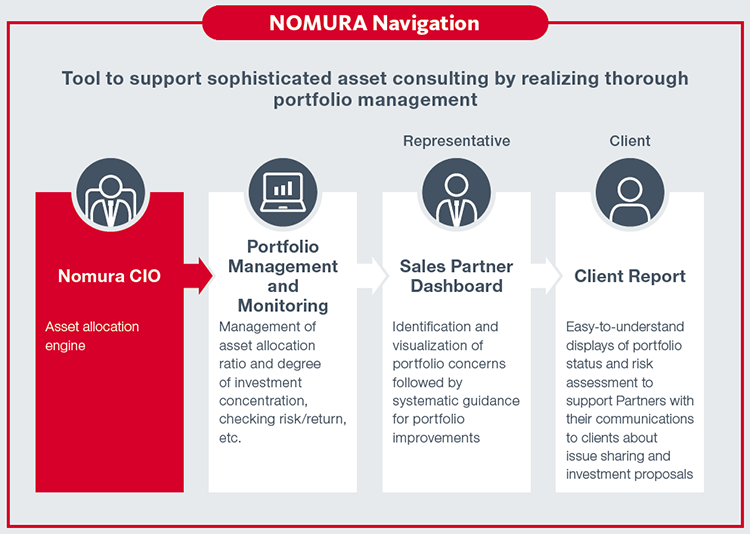

- In July 2020, we established the Chief Investment Office (CIO) Group with the aim of fully implementing the high value-added advisory model. In the CIO model, we aim to build an even more advanced advisory function by providing consulting services similar to those already offered towards institutional investors, to individual investors.

- In November 2020, we introduced the CIO model for discretionary investment services to improve operational performance. In June 2021, Nomura Navigation, a tool for managing clients’ portfolios, was introduced as a precursor to the CIO model. We provide high-quality services including the development of asset allocation plans, portfolio monitoring, and identifying and solving financial concerns through comprehensive, personalized investment proposals.

- We are considering the introduction of a new “level fee” structure, in which fees are charged according to the level of client assets (Trial operation started in April 2021, scheduled for full-scale introduction in April 2022).

- By providing a fee structure that fulfils the individual needs of our client, we aim to increase client satisfaction and client assets under custody.

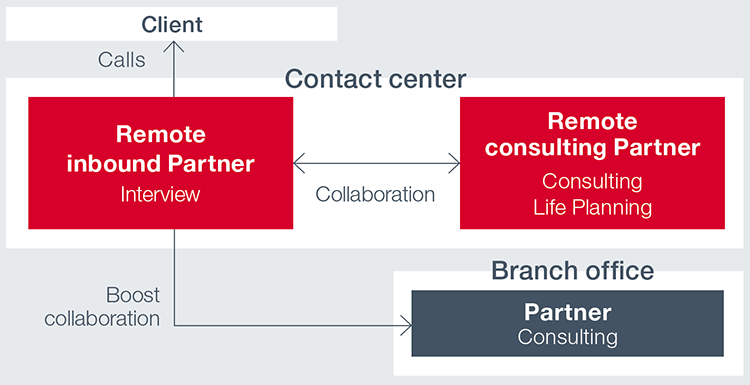

- The contact center is positioned as a strategic sales base, and in addition to providing general inquiries from clients and consulting on market outlook, we have established a system in which specialized partners* can use tools to provide a wide range of services such as consulting and life planning and design portfolios.

- Last year, we expanded our network from three to seven centers and increased our number of specialized partners.

- We will provide high-value-added services that meet the individual needs of as many clients as possible through our contact centers.

- We call our sales representatives “Partners” because we want to be the most trusted financial service group for clients

- In August 2019, we established Nomura Orient International Securities Co., Ltd. in China and launched a business for high-net-worth clients in China.

- We will also strengthen international wealth management, mainly in Hong Kong and Singapore. We aim to increase our assets under management to over $35 billion by the end of March 2025.

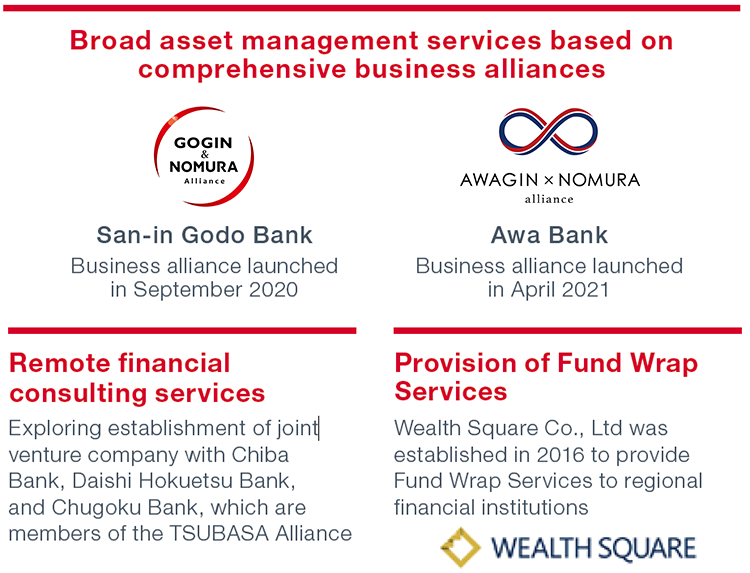

- Form alliances in various ways with regional financial institutions, which have a strong client base in each region, and Nomura Group, which has extensive products lineups and expertise in financial services.

- Our company, along with Nomura Research Institute, is jointly developing a new financial services platform that integrates IT functions to provide financial intermediaries and other financial institutions with sales and operational expertise to support their businesses.