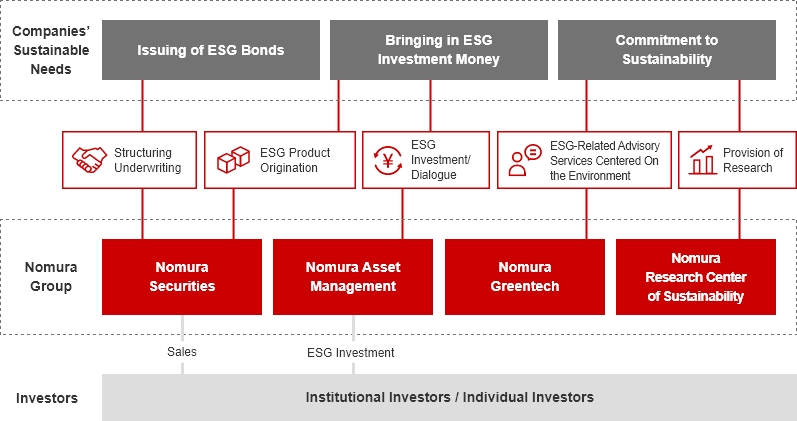

Nomura Group provides financial services that contribute to the creation of a sustainable society under the management vision of "Reaching for Sustainable Growth". Nomura will continue to promote initiatives to achieve the SDGs and contribute to economic and sustainable social development, while contributing to the growth of sustainable financial market.

Nomura's Role in Sustainable Finance

Nomura Group companies will continue to work together across the board with their respective expertise to maximize the collective strengths of the Group to meet the needs of investors and clients and realize a sustainable society.

Our Focus

With the aim of realizing a sustainable society, we help clients with their needs, including green bonds and other types of financing and financial solutions.

Through the development and provision of sustainability-related products, we provide our customers with a wide range of choices, and contribute to solving social issues and developing financial and capital markets.

As a responsible institutional investor, we aim to realize a sustainable and prosperous society by helping clients build wealth.

We are advancing research in the field of sustainability, and contributing to the realization of a sustainable society through financial and capital markets.

Ashiya City, which has been working on SDGs, social contribution, and environmental issues through the management of funds, and the Japan Railway Construction, Transport and Technology Agency (JRTT), which has been issuing green bonds since fiscal 2017 and sustainability bonds since fiscal 2019, held an engagement meeting aimed at the further development of the SDGs bond market.

An engagement meeting aimed at further development of the SDGs bond market was held between Namie Town and the Urban Renaissance Agency. Namie Town has been investing in SDGs bonds while giving due consideration to security and efficiency, as the city is recovering from the complex disaster caused by the earthquake and tsunami triggered by the Great East Japan Earthquake and the nuclear disaster caused by the damage to the Fukushima Daiichi Nuclear Power Station. The Urban Renaissance Agency is an independent administrative agency that has continuously issued social bonds since fiscal year 2020 and started issuing sustainability bonds this fiscal year.

The Soto Sect, the largest mono-religious sect in Japan with approximately 14,000 temples, and the Japan International Cooperation Agency (JICA), the only ODA implementing agency in Japan, which issued Japan's first social bonds in 2016, jointly discussed the themes of food, disaster prevention and reconstruction, and peace.

Japan Earthquake Reinsurance Co., Ltd. (hereinafter, "Japan Earthquake"), the only reinsurance company for household earthquake insurance in Japan and which actively invests in SDG bonds to manage and administer insurance premiums, and Japan Student Services Organization (hereinafter, "JASSO"), which issues social bonds on a regular basis, held an engagement meeting targeting the further development of the SDG bond market.

With growing interest in ESG investment to solve social issues, we held a conversation between Japan Student Services Organization (the issuer) and The Pack Corporation (the investor), with a focus on "Providing quality education for everyone" (SDG Goal #4) and how they are working toward the same goal. They discussed their approaches and ideas on SDGs.

The Nomura Research Center of Sustainability was established in order to advance research on sustainability and contribute to the realization of a sustainable society through the financial and capital markets. In this feature, we introduce Nomura Group's aims behind the establishment of the center, as well as some comments from a few of the center's external advisors.

As recognition of the SDGs increases, the issuance amount of SDG bonds comprising green bonds, social bonds, and sustainability bonds, which aim to tackle environmental and social issues, has been continuously increasing. Nomura Group is providing the market with a wide range of information in order to encourage demand for funds among companies seeking to solve challenges and connect them with investors aiming to contribute to society through investment.