Nomura Group regards thorough Compliance Risk management as one of the most important principles in managing its businesses. Compliance Risk means the risk of financial loss or reputational damage due to violations of financial services laws, rules or regulations, and improper conduct which disrupts the integrity of the financial markets and causes unfair client treatment. This includes Conduct risk arising from conduct or behaviors and activities of Nomura Group executives or employees that deviate from the Nomura Code of Conduct or violate financial services laws, rules, regulations, or the applicable Company policies and procedures. Nomura Group regards Compliance not only as legal compliance, but also fulfilling the roles expected by society by acting and behaving in accordance with the social norms and ethics expected of executives and employees in the financial services industry.

Nomura Group has established the Group Compliance Risk Management Policy and the Nomura Group Conduct Risk Management Policy that outline the framework and the structure for putting Compliance Risk management into practice in daily business operations. Additionally, the Group has established the Nomura Group Code of Conduct as a guideline for concrete actions based on the common values of "Entrepreneurial Leadership", "Teamwork" and "Integrity". Various initiatives based on the Nomura Group Conduct Program are implemented to embed proper conduct. Furthermore, Nomura Group practices appropriate risk management based on the Three Lines of Defense approach, which defines roles and responsibilities, and establishes the fundamental requirements of actions for Compliance Risk management.

All Group companies and departments establish thorough compliance and adequate control frameworks to ensure that their members do not engage in activities suspected of being in violation of laws or regulations. In the event that such issues arise, they are reported to members of senior management and handled appropriately.

Nomura Group appoints a Chief Compliance Officer (CCO) to oversee the Group's compliance framework. In addition, all Group companies and overseas regions have a Compliance Officer. The CCO works with the Compliance Officers of each company and overseas region through instructions to the Group Compliance Department and other means, ensuring the internal control system is adequately established and maintained in line with global business development.

Nomura Group has established the Nomura Group Conduct Committee as an executive committee responsible for examining the Compliance Risk management framework, discussing important matters, promoting various measures, and verifying the effectiveness of programs through monitoring. Matters deliberated by the Nomura Group Conduct Committee are reported to the Executive Management Board as well as the Board of Directors on a regular basis. Both the execution side and the oversight side monitor and ensure that the Nomura Group Conduct Risk Management Policy is complied with and that the initiatives based on the Nomura Group Conduct Program are properly implemented.

Nomura Group believes that Compliance is not limited to legal compliance but is also about acting based on common sense that aligns with social norms and ethics expected from executives and employees in the financial services industry. In order to achieve a higher level of Compliance Risk management, the Group is committed to further strengthening the internal control system.

In the event of a significant violation of laws and/or regulations that may undermine trust in the financial and capital markets, or may have a significant impact on the Company's reputation and/or finances, following an investigation relevant information will be promptly disclosed on the Company website.

Nomura Group provides comprehensive compliance and conduct training for all executive officers and employees on topics such as proper conduct, human rights issues including harassment, combating money laundering and the financing of terrorism, managing conflicts of interest, preventing insider trading, complying with firewall regulations, and managing client information. We are working to raise the level of legal and regulatory knowledge among executives and employees, raise compliance awareness, and foster a corporate culture of pursuing appropriate business practices.

Nomura Securities' Primary Initiatives

- Training for sales officers, internal controls officers, and employees of internal controls departments, as well as quality improvement training for securities sales representatives

- Training for branch managers, Wealth Management compliance managers, new employees, newly appointed personnel, and others, aimed at increasing knowledge and deepening the understanding of compliance

- Supplementary compliance education and drills during various training sessions and meetings

- Training for Compliance Officers

- Compliance Hour* at branch offices and departments

- Training programs to promote proper conduct

- Training programs to ensure awareness of human rights issues

※To ensure that each and every employee throughout the Company understands the need for full compliance, training sessions are generally held once a month in the branches and offices of Nomura Securities.

Nomura Group companies have established whistleblowing systems (Compliance Hotline) based on the Nomura Group Whistleblowing Policy and the Regulations on Management of Nomura Group Compliance Hotline. The hotline provides all executives and employees (including temporary employees and former employees within one year of retirement) with the means to directly report any suspected violations of laws and regulations, breaches of the Nomura Group Code of Conduct, or suspicious accounting or auditing activities.

We are also working to raise awareness and promote the use of the hotline through internal distribution of management messages and the intranet, and to create a psychologically safe environment in which anyone can speak up when they feel something is wrong.

The hotlines can be contacted anonymously, and the information provided is then investigated as necessary under the direction of the information recipient, with priority placed on maintaining the confidentiality and anonymity of the whistleblower. If a problem is found after an investigation, appropriate corrective actions are taken and measures are carried out to ensure that the whistleblower and persons who cooperated in the investigation do not receive disadvantageous treatment, such as reprisal, for having provided information.

The operating status of Group companies' hotlines, including investigation results and corrective actions, is reported to the “Nomura Holdings Audit Committee” on a quarterly basis to ensure the legal compliance system is being maintained and is effective.

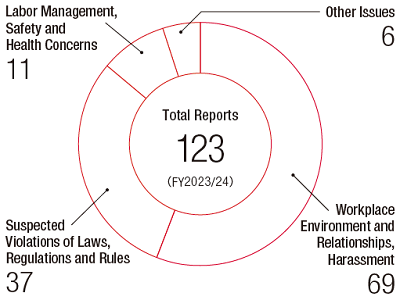

The following shows the total number of reports raised globally in FY2023/24. Investigations are conducted on all reports received and responded appropriately.

Nomura Group Compliance Hotline

The Nomura Group Compliance Hotline is provided for domestic Group companies. Anonymity is ensured through the use of an external consultation desk, provided by a professional service provider, where external and internal information recipients can be selected. A dedicated website is also available 24 hours a day.

Under applicable laws and regulations, including the Financial Instruments and Exchange Act and the Personal Information Protection Act, Nomura Group works to properly protect customers' assets and information.

Nomura Securities properly segregates customer assets from its own assets. Nomura Securities has requested EY Shin Nihon LLC to conduct assurance in accordance with Assurance Practical Guideline 3802 “Practical Guideline on Assurance Related to Legal Compliance of Segregated Management of Customer Assets” of the Japanese Institute of Certified Public Accountants. Nomura Securities has received from the auditor a written assurance to the effect that management's arguments in the management report on the segregation of customer assets are consistent in all material respects as of March 31, 2024 with laws and regulations as well as the “Rules Concerning Appropriate Implementation, Etc. of Separate Management of Customer Assets” of the Japan Securities Dealers Association and the “Segregation Management Implementation Rules” of the Security Token Offering Association.

The Nomura Group Information Security Policy provides the basic principles for appropriately protecting information assets.

Each Group company has its own information security-related regulations in accordance with this basic policy. We are also working to enhance the management of information provided to customers in accordance with the characteristics of each company's business activities. In particular, customer-related personal information is handled in line with rigorous standards set out in the Nomura Group Privacy Policy and other information security-related rules, and is handled by Nomura Group executives and employees in full compliance with the Personal Information Protection Act and other related laws and regulations. We will retain personal data only for as long as necessary for the relevant processing activity and/or for as long as is necessary to comply with all relevant statutory and regulatory requirements within the scope of the Purpose of Utilization.

In the event that personal information, etc. is provided to an external contractor, in accordance with the Nomura Group Privacy Policy and the Nomura Group Vendor Risk Management Standard, a system to prevent the leakage of confidential data, such as customer information, is to be confirmed before the contract is signed, and after the contract is signed, the applicable group company will take responsibility for ensuring that the external contractor has proper systems in place to protect the privacy of such personal information, etc. In addition, the Nomura Group Privacy Policy states that disclosure, correction, and termination of usage (suspension or erasure of use) shall be conducted in accordance with all relevant laws and regulations upon the request from an individual, and each company has its own applicable procedures in place. Training sessions for executive officers and employees are held on a regular basis, including when they join the firm and then on an annual basis, as part of our efforts to ensure no leakage or inappropriate use of personal information will occur and to enhance information security protection.

Nomura Securities Co., Ltd. appointed an Information Security Manager and a checker for each department to thoroughly safeguard personal information, including the Individual Number, by overseeing the management or handling of the following items. In addition, in the case of outsourcing, we prohibit the use of information for purposes other than the operations being outsourced, and require contractors to establish sufficient measures to ensure the safe management of information, through management measures pertaining to affirmations and statements, etc., and the implementation of prompt improvement measures in the event that areas for improvement in the management of information acquired from our company are identified. We may share personal data within Nomura Group and with third parties in connection with the purposes described in Privacy Policy.

- The status of personal information management before leaving the office

- Electronic files containing personal information

- Personal information ledgers

- Contractor pledge forms, statements, etc.

- Procedures controlling the removal of client information outside the company

- Responses to disclosure requests

- Training and other activities related to information management

- IDs/passwords

- E-mail correspondence with parties outside the company and information terminals

- External recording media

- Information the company delivers by fax

- Access logs during late night hours and holidays

Under the Nomura Information Security Management Regulations, Nomura Securities Co., Ltd. appoints a Chief Information Security Officer from the executive officers. The Chief Information Security Officer takes responsibility as the "personal data management supervisor" as defined in the Financial Services Agency's Practical Guidelines on Security Control Measures Under the Guidelines for Protection of Personal Information in the Finance Sector and strives to ensure Information Security.

In addition to the inspection conducted by each branch and department, an "auditor in charge" as defined in the Practical Guidelines conducts periodic inspections to ensure both the proper handling of information assets as well as information security. Any incidents involving potential misuse of personal data such as loss, unauthorized access, disclosure, unauthorized alteration or unlawful destruction are quickly reported to all related departments, and corrective measures, including actions to prevent recurrence, are taken in response to all incidents.

All Nomura Holdings, Inc., Nomura Securities Co., Ltd., Nomura Asset Management Co., Ltd., and The Nomura Trust and Banking Co., Ltd. department and branch office heads serve as Information Security Managers. These Information Security Managers, accountable as "personal data managers," are responsible for the security and proper management of information assets handled by their work area and for properly providing their staff with advice and guidance in this regard.

In order to accommodate the diverse needs of its clients, the Nomura Group provides a wide range of its services over the Internet. These services use the latest, most advanced encryption technologies to ensure that important client information is always safeguarded. Furthermore, we have strengthened surveillance of our in-house systems and implemented new security systems in order to prevent illegal access from external parties or information leakages caused by cyberattacks, which have become increasingly threatening in recent years.

Nomura Group seeks to enhance the quality of financial products and services offered to customers under the Guidelines for Financial Instruments Business Supervision. To this end, the firm has implemented various initiatives which include the following:

Nomura Securities' Primary Initiatives

- Appointing officers to oversee internal controls, compliance, etc., and developing systems to ensure compliance and the appropriateness of operations

- Thoroughly screening account openings and conducting proper examinations when underwriting securities

- Carefully reviewing product details and taking action to provide accurate and comprehensive information

- Conducting sales and solicitation activities in compliance with the Financial Instruments and Exchange Act and laws and regulations governing each operation with an overall understanding of the customer's knowledge of financial instruments and financial status

- Structuring systems that establish guidelines for sales to senior customers and requiring compliance with these guidelines

- Ensuring thorough compliance with laws, regulations, and internal rules through compliance training

Nomura Group shall implement money laundering and terrorist financing countermeasures, shall prevent bribery, and shall not carry out transactions with anti-social forces or groups, or transactions with those subject to economic sanctions which are prohibited by laws, etc.

The Nomura Group Code of Conduct sets forth the basic policy of preventing money laundering and combating the financing of terrorism (AML/ CFT) with a high level of control to prevent proceeds from criminal activity from flowing into the financial and capital markets or to be used to finance terrorism. Nomura has also established the "Nomura Group Anti-Money Laundering and Combating the Financing of Terrorism Policy", a global policy on AML/CFT that stipulates the common rules to be established in each region and at each subsidiary. We have also established specific standards that apply across the entire Group in areas of particular importance, such as client due diligence and responding to economic sanctions. Nomura Group is working to strengthen its AML/CFT management system throughout the Group by complying with the laws and regulations of each country and by closely monitoring international regulatory developments, including recommendations by the Financial Action Task Force (FATF).

The Group AML/CFT Head is responsible for establishing and maintaining the effectiveness of Nomura Group's AML/CFT management system. The Group Compliance Department Financial Crime Unit was established to assist the Group AML/CFT Head in maintaining an effective AML/CFT management framework. Each Nomura Group company designates an Anti-Money Laundering Compliance Officer who is responsible for that company's AML/CFT management framework. Nomura Securities appoints AML/CFT Officers in each department and branch to oversee the planning and implementation of the AML/CFT management framework.

- Group AML/CFT Head: Responsible for establishing and maintaining the effectiveness of Nomura Group’s AML/CFT frame work

- Group Compliance Department Financial Crime Unit: Assist the Group AML/CFT Head to maintain and establish an effective AML/CFT framework

- Anti-Money Laundering Compliance Officer: Designated at each Nomura Group company and is responsible for the company’s AML/CFT framework

- AML/CFT Officers: Appointed in each department / branch of Nomura Securities to plan and implement the AML/CFT framework

Nomura Securities Co., Ltd. (NSC), in accordance with "Act on the Prevention of Transfer of Criminal Proceeds" and NSC's risk assessment based on a risk-based approach, conducts a customer due dilligence including (but not limited to), for individual customers: the name, address, date of birth, purpose of the transactions, occupation, etc. or for corporate customers, the name, the location of the head office or principal office, purpose of the transaction, nature of the business and beneficial owners, etc. In addition, NSC requires obtaining additional information from the customer and/or the approval of senior management according to the risk inherited in the transaction. Where online transactions occur, additional due diligence is conducted to mitigate risks.

Furthermore, enhanced due diligence based on a risk-based approach is conducted for high-risk transactions, such as transactions with foreign Politically Exposed Persons (PEPs) and those who reside in designated high-risk countries from an AML perspective.

Moreover, the Firm conducts transaction monitoring using a specific system on a daily basis for potential unfair trading in relation to money laundering, financing of terrorism, market manipulation, intentional market making, transactions using fictitious names and insider trading. If a potential unfair transaction is detected through the transaction monitoring, we will request for additional information as necessary and take appropriate steps such as; alerting the customer, request for additional information, restricting transactions and/or terminating the contract.

Overseas offices are also working on preventing unfair trading by taking AML/CFT initiatives based on a risk-based approach through measures such as customer due dilligence, suspicious transaction reporting and enhanced due dilligence on high-risk transactions.

AML/CFT-related documents such as records of verification at the timing of transaction and transaction screening are kept in line with regional policies and procedures (for Japan, the retention period is seven years in principle.).

In accordance with the audit plan formulated using the risk assessment method, the internal audit department periodically examines the effectiveness of AML/CFT initiatives and compliance with AML/CFT program.

Nomura Group Anti-Money Laundering and Combating the Financing of Terrorism Policy

(Overview)

Nomura and Nomura companies have established the Group Anti-Money Laundering ("AML") and Combating the Financing of Terrorism ("CFT") Policy (the "AML/CFT Policy"). The AML/CFT Policy describes Nomura's AML/CFT management structure to comply with all applicable AML/CFT laws, rules and regulations (collectively, "AML/CFT Requirements") where Nomura operates.

AML/CFT Management

The Group AML/CFT Head is the person responsible for Nomura's AML/CFT management, assigned as the Chief Compliance Officer. The Group AML/CFT Head shall regularly report matters relating to the management of the Nomura AML/CFT framework to the Executive Management Board.

Monitoring and Reporting Suspicious Activity

Nomura and the Nomura Group companies have established and maintain appropriate policies and procedures in compliance with applicable AML/CFT Requirements. All officers and employees of Nomura (collectively, "Personnel") are required to report any suspicious activity in a timely manner to their respective Anti-Money Laundering Compliance Officer (collectively, "AMLCO"), where allowed in accordance with applicable laws, rules and regulations in their respective jurisdictions.

Management and Controls of AML/CFT Risk

- Money laundering/terrorism financing risk assessment and analysis

- Actions to be taken if there is a high risk of money laundering/terrorism financing

- Customer Due Diligence (CDD) Program

- Sanctions Program

Training

Nomura and Nomura Group companies will establish and implement training programs for the purpose of maintaining and improving the AML/CFT awareness and competency of personnel.

Records Retention

All necessary customer records are to be maintained for the applicable time periods set forth by Nomura and Nomura Group companies in accordance with applicable laws, rules and regulations.

Independent Testing

Independent testing and adherence to the requirements of this AML/CFT Policy and the Individual AML/CFT policies or equivalent will be performed by objective and qualified third-party auditors and/or by an appropriate department in charge of testing. Independent testing must be conducted by an individual who is independent from the AML/CFT function.

Maintenance of the AML/CFT Policy

The NHI Financial Crime Department reviews this AML/CFT Policy on a periodic basis and makes revisions where necessary. The approval of the Executive Management Board is required to make a revision to or abolish this AML/CFT Policy.

(Revised in February 2020)

In order to eliminating anti-social forces, the Nomura Group outlines in "Code of Conduct of Nomura Group", we make the policy to decide to eliminate anti-social forces or groups, and our fundamental policy is to eradicate all ties with anti-social forces. The "Code of Conduct of Nomura Group" is applicable to all management and employees globally.

Nomura Group's Code of Conduct requires all employees to understand and comply with the letter and spirit of all applicable laws, rules and regulations, which include anti-bribery and corruption and tax evasion.

With the approval of the Executive Management Board, Nomura Group has established the Nomura Group Anti-Bribery and Anti-Corruption Policy as a global policy to establish standards to be observed in each region and at each subsidiary. Under the supervision of the Chief Compliance Officer (CCO), a consistent framework across Nomura Group to prevent bribery and corruption is being enhanced.

Employees are able to report potential legal/regulatory violations such as bribery, as well as any activities that infringe on the Code of Conduct of Nomura Group through the Nomura Group Compliance Hotline.

Nomura Securities has established policies and procedures for providing gifts and entertainment to individuals including public officials and private sector groups. These policies and procedures are disseminated throughout the company to ensure fair business practices and prevent bribes. Gifts and entertainment are not provided to public officials and private sector groups in Japan who may have a vested interest. Where gifts or entertainment is provided to non-Japanese public officials, we determine the appropriateness in advance based on applicable local laws and regulations. Expense accounts are subject to regular monitoring to ensure they are used appropriately. In addition, training is conducted periodically to reinforce our corporate policies and procedures regarding gifts and entertainment.

Internal Audit division regularly investigates and assesses internal control on anti-bribery and corruption to ensure its effectiveness from a framework and appropriateness of operation perspective, and recommend business improvement based on the results.

Overseas offices also implement a report, approval process and procedures for gift and entertainment to public officials to strictly prohibit any unfair or suspicious transactions.

- Thorough dissemination of legal compliance and internal regulations, as well as periodic training

- Establishment of the Nomura Group Anti-Bribery and Anti-Corruption Policy, as well as related rules and the guidelines for gifts and hospitality. These prohibit bribery and corruption, provide training and monitoring, and maintain reports and records.

Nomura Group

Anti-Bribery and Anti-Corruption Policy

(Overview)

Nomura Group has established the Nomura Group Anti-Bribery and Anti-Corruption Policy in an effort to prevent bribery and corrupt conduct. This policy declares the risk-based approach to Group's anti-bribery and corruption principles.

Responsibilities

The Chief Compliance Officer (CCO) is responsible for ABC governance within Nomura Group.

Prohibition of Bribery and Corruption

Nomura Group prohibits Bribery and Corruption directly or indirectly in all executives and employees’ conduct of Nomura’s business.

※“Bribery and Corruption” shall mean initiating or engaging in one of the following acts: (i) offering, giving, soliciting, receiving or promising of anything of value, directly or indirectly, if improperly intended to influence action or obtain an advantage; or (ii) making any other unlawful payment, rebate, payoff or kickback or taking any other action that would violate applicable ABC laws and regulations.

Gifts and Hospitality

Nomura Group shall adopt appropriate approval procedures in Local Rules to manage Gifts and Hospitality (entertainment, gifts, meals, travel expenses or other corporate hospitality, etc.) in accordance with local laws, social standards and business practices, etc. All executives and employees must abide by this Policy and all relevant Local Rules regarding providing or receiving gifts and hospitality.

Facilitation Payments

Nomura Group prohibits making any payment for the purpose of expediting or facilitating the performance of a Public Official for a routine action.

Donations, Sponsorships and Political Contributions

Nomura Group shall not provide or agree to provide donations, sponsorships or political contributions, which constitute Bribery and Corruption.

Third Party Intermediaries

Nomura Group shall not conduct any activities which constitute Bribery and Corruption when Nomura Group uses any third party, which includes vendors, referring parties, and intermediaries.

Monitoring

Nomura Group shall establish an appropriate program to monitor Nomura employees for the prevention of Bribery and Corruption.

Training

Nomura Group shall implement training programs for the purpose of maintaining and improving ABC awareness and competency of Nomura employees.

Record Keeping

Where approvals are required under this Policy, Nomura Group must retain these records.

Reporting and Whistleblowing

All executives and employees are required to report the occurrence of, or the suspicion of, Bribery and Corruption within Nomura Group to the Compliance Officer in accordance with Local Rules.

Independent Testing

Independent testing will be performed by an objective and qualified third-party auditor and/or by an appropriate department in charge of internal auditing.

In FY2023/24, there were no relevant cases or fines or settlement costs found to be in violation of the Policies.

In accordance with laws and regulations, Nomura Securities prohibits accepting orders knowing that they violate or are likely to violate insider trading laws and regulations. Also, in order to prevent insider trading, we have prepared an insider registration card. When accepting an order from a related party of a listed company (an insider), we first confirm that the order will not be an insider trade or the party in question does not possess undisclosed material information. Furthermore, Nomura Securities has established the "Regulations on Corporate Confidential Information Management", and the "Regulations on Material Nonpublic Information obtained from Public Officials." These regulations stipulate the systems for managing and reporting undisclosed corporate information and undisclosed material information, as well as the prohibited acts such as soliciting securities if in possession of such information.

Nomura Group provides global financial services through numerous Group companies. We have established a conflict of interest management system based on the "Nomura Group Conflicts of Interest Management Policy" to ensure that conflicts of interest with customers do not materialize. Specifically, each Group company develops its own system to appropriately manage conflicts of interest. Nomura Holdings' Group Compliance Department, which is in charge of managing conflicts of interest, determines whether a risk of conflicts of interest exists within Nomura Group. If there is concern about a conflict of interest, the Nomura Holdings Group Compliance Department appropriately manages the situation to prevent any conflicts of interest from materializing.

Nomura Securities examines transactions on a daily basis to determine whether there is a risk that our own transactions, or those we execute on behalf of clients, could constitute unfair trading, such as market manipulation, intentional market formation, or insider trading. Based on the review, we interview and give warnings to those persons who have engaged in transactions that are suspected of being unfair. We continuously monitor transactions in accounts for which we deem there to be a risk of recurrence of suspicious trades. If no improvements are seen, we stop executing received orders, and take other appropriate measures. In addition, we periodically analyze the results of examinations, verify the effectiveness of the examinations and the soundness of the examination system as part of our effort to build and maintain an appropriate trading management framework.

Nomura Group Tax Policy is approved by the Executive Management Board and sets out the firm's approach to appropriate tax governance.

-

Nomura Group Tax Policy

(66KB)

Nomura Group Tax Policy

(66KB)

You may report to us your concerns regarding our accounting, internal accounting controls or auditing matters via the feedback link below.

Nomura Group outsources various operations to outside providers. In order to fulfill our social responsibility, we are requesting our outsourced service providers to understand the purpose of the "Code of Conductof Nomura Group" and act in accordance with it. As such, we ask that you take the time to read the code by accessing the link below.

If after reading the code you become aware of any issues that you feel we should know about, please contact us via the feedback link below.