Wealth Management aims to help clients achieve their goals by delivering comprehensive asset management services. We have been transforming our business model for over a decade by focusing on a recurring revenue businesses where we earn management fees on the assets entrusted to us by clients. In this business model, our revenues are proportional to client assets which ensures the interests of our clients and Nomura is aligned, strengthening our client relationships as we pursue financial growth together.

Additionally, in FY2023/24, we addressed shifting client needs by significantly increased the number of Sales Partners providing face-to-face consulting services and optimized our client coverage system. These initiatives have driven improved client satisfaction and business growth.

Our future growth strategies aim to achieve: establish a dominant brand position in the High-Net-Worth Individuals (HNWI) market; expand business with emerging wealth clients through the Workplace business; strengthen client touchpoints, offer services to further enhance productivity of Sales Partners through utilizing digital tools.

By accelerating these initiatives, we will help realize more clients’ financial aspirations, establish a formidable competitive advantage, and sustainably expand our client base. Through expanding our recurring revenue based business and maximizing assets under management, we are driving sustained growth.

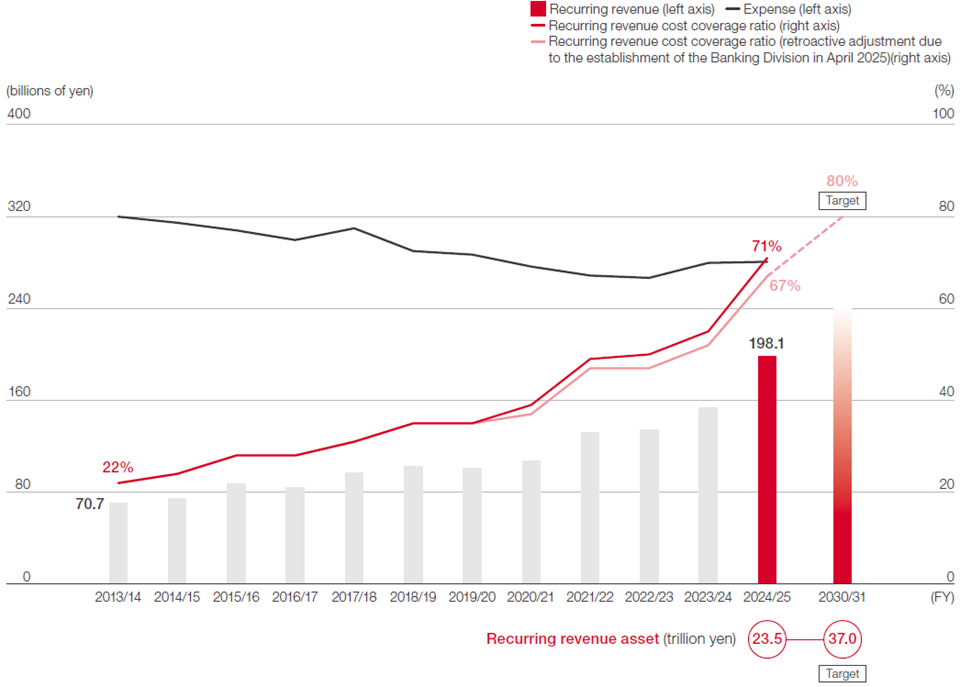

Recurring revenue and recurring revenue cost coverage ratio

* Actual figures prior to FY2024/25 are before retrospective adjustments due to the establishment of the Banking Division in April 2025.

We have been striving to expand our recurring revenue business to further strengthen relationships with our clients and establish a revenue base that is resilient to market fluctuations. As a result of sustained effort over many years, we have steadily accumulated recurring revenue assets, and recurring revenue has grown significantly. The recurring revenue cost coverage ratio has grown from approximately 22% a decade earlier to 67% in FY2024/25. Looking ahead, we aim to build an even more stable profit-generating revenue base by increasing recurring revenue assets to over 37 trillion yen and raise the recurring revenue cost coverage ratio to over 80% by FY2030/31.

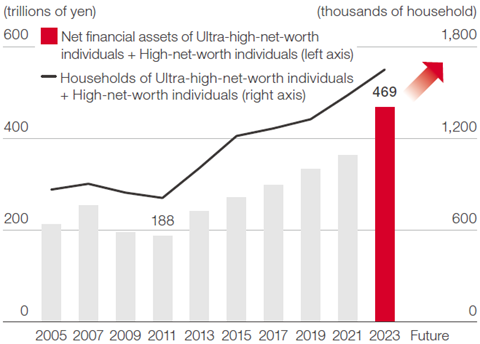

Japan’s HNWI market is on an upward growth trajectory. These clients face complex and diverse challenges, and highly value Nomura’s personalized consulting services. Based on this understanding, we have significantly increased the number of Sales Partners who provide face-to-face services. By limiting the number of clients assigned, we are able to offer more comprehensive and personalized service to improve client satisfaction, while also strategically allocating resources towards acquiring new clients. As a result, leading to increased client activity and steady expansion of our HNWI client base.

Source: Estimated by NRI based on National Tax Agency “National Tax Agency Annual Statistics Report”, Ministry of Internal Affairs and Communications “Family Income and Expenditure Survey”, Ministry of Health, Labour and Welfare “Vital Statistics”, National Institute of Population and Social Security Research “National projection of the number of households in Japan”, Tokyo Stock Exchange, Inc. “TOPIX”, NRI “Questionnaire Survey of 10,000 Consumers (Finance Edition)”, and “Survey of high-net-worth individuals”. The classifications are as follows; “Ultra-highnet-worth individuals”: those with net financial assets of 500 million yen or more, “High-net-worth individuals”: those with net financial assets of 100 million yen or more but less than 500 million yen.

To drive further growth, we aim to continue strengthening our dominant brand presence in the expanding HNWI market. In April 2024, we launched the NOMURA WEALTH MANAGEMENT brand built under the concept of “Anticipating Change, Creating Your Future Together.”

Our greatest value lies in our people, and we are enhancing our training system to continuously develop talent who embody the skills, values, and mindset essential to drive our brand forward.

Additionally, we are leveraging Nomura’s position as an employer of choice in the recruiting and attract outstanding talent. Through raising awareness and affinity for NOMURA WEALTH MANAGEMENT, we will build an unrivaled brand presence, reinforce competitive advantages, sustainably expand our client base, and achieve remarkable growth.

Through leveraging our corporate relationships, we can expand our Workplace business that supports companies’ human capital management and assists employees with asset building. The number of workplace service accounts through ESOP, corporate DC, and workplace NISA has expanded to 3.88 million as of the end of March 2025.

Employees of listed companies represent an important “emerging wealth” client segment with potential to become HNWI in the future. We are enhancing the channels for securities account openings through the Workplace business and working to expand our client base over the medium- to long-term. We also utilize digital marketing to attract current working generation clients seeking financial services, while offering retired generation clients more personalized and direct guidance delivered by Sales Partners. By serving as a trusted Sales Partner who supports business people’s lifetime financial journey, we aim to drive deep client engagement and activity.

We are developing a client-centric service delivery framework that integrates digital tools and enhances Sales Partners capabilities. Our asset management app “NOMURA” has continued to evolve with expanded features and improved functionality, reaching 1.78 million downloads as of June 2025 and steadily amplified digital engagement with clients.

Clients can manage their assets more conveniently by using the app to check investment information and asset status at their own timing, while receiving asset management services from their partners. This integrated approach helps clients manage their investments with confidence, improves overall client satisfaction and enables the introduction of new technologies such as AI to enhance divisional productivity.