May 2022

Agricultural risk – hardly chicken feed

Fossil fuels are not the only items for which the Ukraine conflict has affected supply: Ukraine and Russia are both major exporters of food and fertilizers. According to the UN’s Food and Agriculture Organization (FAO), Ukraine and Russia each ranked among the top three exporters of wheat, maize, rapeseed, sunflower seeds, and sunflower oil in 2021. Moreover, Russia is a major exporter of fertilizer ingredients, ranking number one in the world as an exporter of nitrogen fertilizer, number two as a producer of potash fertilizer, and number three as an exporter of phosphorus fertilizer. A major reduction in the supply of food and fertilizers from Ukraine and Russia would pose the threat of a global food crisis.

Ukraine, with its rich, black soil, is known as the bread basket of Europe

The Ukrainian government has made an effort to release some information about food production. According to the Ukrainian Ministry of Economy, the country's agricultural exports (maize, wheat, sunflower oil, and soya) in March were only a quarter the level of the previous month (note that the data is probably not seasonally adjusted). Given that March was just after the conflict erupted, it is hardly surprising that exports of agricultural products were badly affected. According to Ukrainian Deputy Minister of Agrarian Policy and Food Taras Vysotskiy, the country expects to export some $15.1bn of agricultural products this year. This is 45.5% less than the $27.7bn it exported last year, and would be very bad news for those countries in Europe, the Middle East, and Africa that depend on agricultural products from Ukraine.

International organizations are analyzing the situation to decide what to do

On April 11 the World Trade Organization (WTO) published a list of countries that may be able to act as alternative sources of supply for the four main products exported by Ukraine and Russia. And according to a simulation by FAO (using different assumptions) the results of which were released on March 25, it will be impossible to make good the shortfall in the supply of agricultural products from Ukraine and Russia in the 2022-23 crop year ("2022-23") and, as a result, the international price of food and fertilizer is likely to rise by some 8-22% from its end-March level.

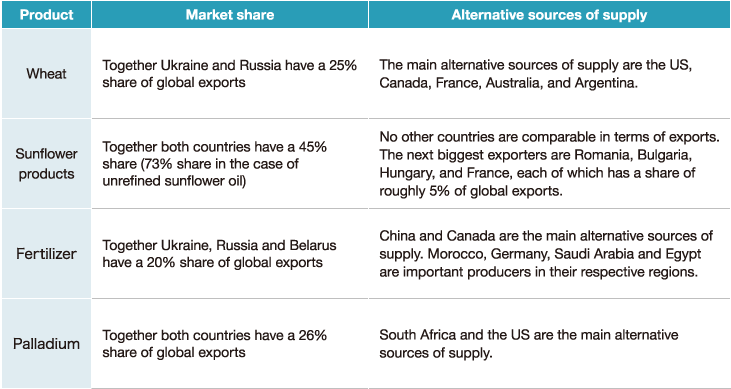

Items for which Ukraine and Russia have a large share of global exports, and alternative sources

Note: "Both countries" refers to both Ukraine and Russia.

Source: Nomura, based on WTO data

Four points to check regarding the food situation, all of which are uncertain at the moment

(1) No one can be sure when the conflict itself will end

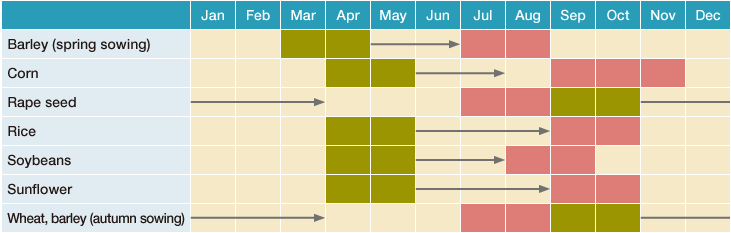

Figure below shows the production cycle for Ukraine's main crops. While the sowing season varies by product and region, for most it is March-May. For these crops the risk that the 2022-23 harvest will be much lower may already have increased significantly. In the case of wheat, the harvest takes place in or around July, and the sowing season is August-September. Much will depend on whether the conflict has abated by then and to what extent agricultural production is possible.

Production cycle of Ukraine's main crops

Note: Based on data from Japan's Agriculture & Livestock Industries Corporation, the USDA's

Office of Chief Economist, and the University of Illinois. The green cells indicate sowing seasons, while the red

cells indicate harvest seasons.

Source: Nomura, based on Agriculture & Livestock Industries Corporation data

(2) There is no hard and fast information on Ukraine's agricultural production capacity

According to a press release by the Ukrainian Ministry of Agrarian Policy and Food on April 14, the Ministry expects 14.01mn hectares to be planted this spring. This would represent a 17.2% decline from 16.92mn hectares in the previous crop year. As the expectation as of April 1 was a 20.6% decline, the situation seems to have improved slightly. That said, of course, the figure could still change depending on how the conflict develops.

(3) It remains to be seen to what extent alternative sources of supply can be relied on

For example, if we take the US, a major agricultural producer, there is no clear indication of any intention to increase the acreage planted in the US Department of Agriculture's Prospective Plantings report, which was published on March 31. As the survey was conducted from February 26 to March 19, just after the Ukraine conflict began in earnest, US farmers are unlikely to have been in a position to adjust their plans. We will therefore have to wait for the publication on June 30 of USDA's Acreage report to see what acreage has actually been or will definitely be planted. It will also be interesting to see what the USDA's World Agricultural Supply and Demand Estimates report scheduled for publication on May 12 has to say. The May issue may well include supply-demand forecasts for the new (2022-23) crop year, and if it does, it may attract the attention US farmers, who may use it to help them decide what acreage to plant.

(4) There is considerable uncertainty surrounding the availability of fertilizer

Fertilizer prices first rose sharply in the middle of last year due largely to Chinese restrictions on the export of fertilizers. The Ukraine conflict has only added fuel to the fire. This is because of bans on the import of fertilizers from Russia as part of the economic sanctions imposed on the country.

Meanwhile, according to the media report, the fertilizer that Japan currently imports from Russia, which accounts for a quarter of its fertilizer imports, will in future be sourced from Canada and Jordan. The agricultural costs in Japan are increasingly likely to rise as the year progresses.

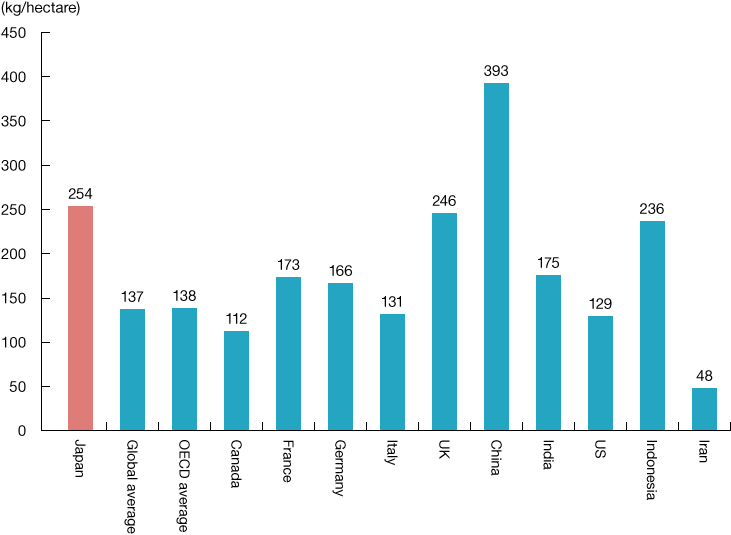

Fertilizer usage per unit of area (2018)

Note: Shows data for G7 countries (Japan, Canada, France, Germany, Italy, the UK, and the US)

and global top five agricultural producers in terms of value (China, India, the US, Indonesia, and Iran).

Source: Nomura, based on World Bank data

We should add that Japan is a country where fertilizer usage per unit of area is higher than the global average. Upward pressure on Japanese agricultural prices from higher fertilizer prices could therefore be greater than in some other countries.

Summary from Nomura research report “Agricultural risk – hardly chicken feed” published on April 25, 2022.