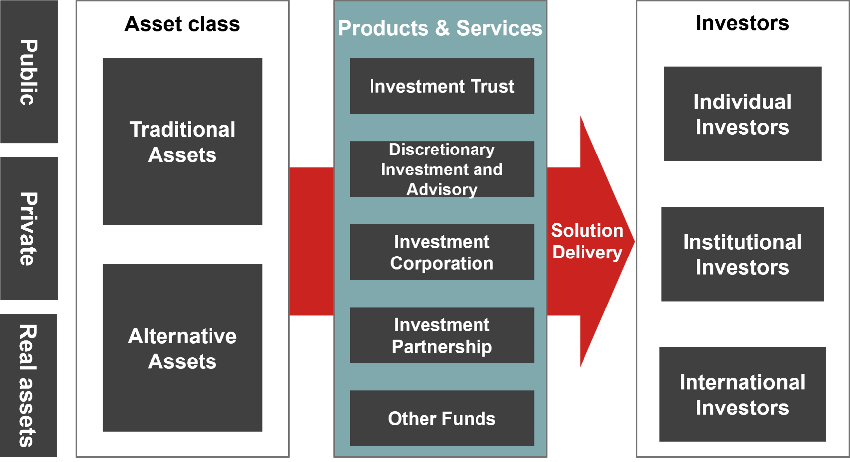

Investment Management offers a broad range of investment products and services—including investment trusts, discretionary investment services, and private funds— to individual investors as well as Japanese and international institutional clients such as pension funds and financial institutions. In addition to traditional assets such as listed stocks and bonds, we manage alternative assets such as private equity and private debt, and real assets such as aircraft leasing and real estate.

Assets under Management

137.8 Trillion Yen

As of January 2026

Global Platform

11 Countries & Regions

Global presence across Asia, Europe and the Americas

Employees

Around 2,000

Global investment professionals

Strategy for Value Creation

By offering high-quality investment products that meet our clients’ diverse needs, we aim to create a virtuous investment cycle that helps resolve social issues.

Enhancing the Asset Management Business

Nomura Group promotes a virtuous investment cycle through the financial markets to help address social issues and support Japan’s development as a leading asset management center.

Group Companies

The Investment Management Division delivers a wide range of asset management services through its global network.

Within the Investment Management division, Nomura Asset Management Co., Ltd. and overseas asset management firms provide services globally under the unified brand "Nomura Asset Management."

|

Japan Nomura Asset Management |

|

International Nomura Asset Management International |

Nomura Capital Partners (NCAP)

We pursue business growth through private equity investments by collaborating with portfolio companies to address challenges and support their expansion.

Nomura Research & Advisory (NR&A)

We engage in buyouts of mid-sized domestic companies to facilitate seamless business succession and provide post-investment growth support.

Nomura Mezzanine Partners (N-MEZ)

We manage private debt funds that primarily provide mezzanine financing for leveraged buyouts of high-quality domestic companies sponsored by private equity funds.

Nomura SPARX Investment (NSPI)

We offer a broad range of investors opportunities to invest growth capital in unlisted companies, thereby expanding funding for private companies and contributing to Japan’s economic growth.

Nomura Babcock and Brown (NBB)

We arrange aircraft leasing and other international transactions to give investors access to high-quality investment opportunities.

Nomura Real Asset Investment (NRAI)

Building on our core expertise in real estate fund management, we develop a broad spectrum of real asset products to cater to diverse investor demands.

Nomura Fiduciary Research & Consulting (NFRC)

We provide specialized asset management services requiring a high level of expertise, including fund evaluation, FoFs (fund of funds) investment advisory, asset management advisory and index services.