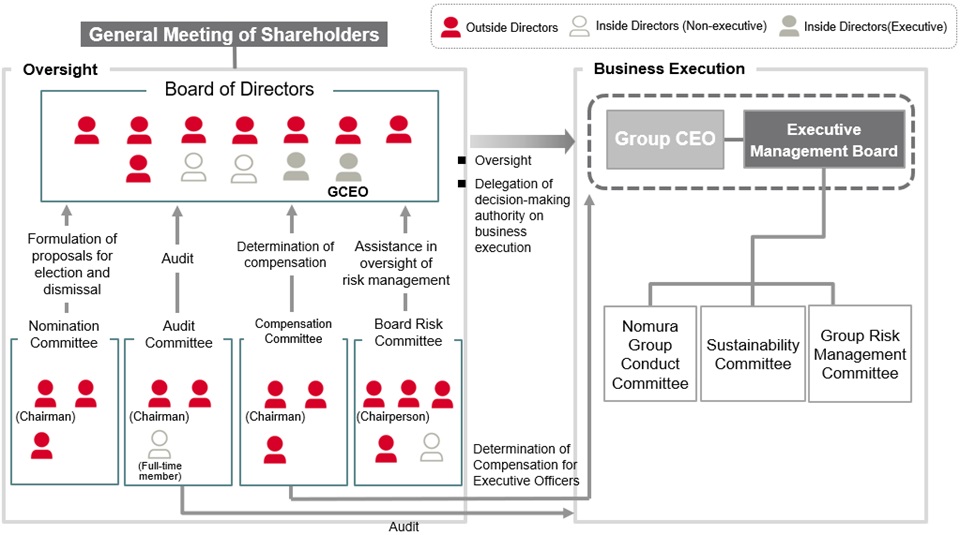

A Company with Three Board Committees establishes Nomination, Audit and Compensation Committees, which are each to be comprised of a majority of Outside Directors, and in addition to striving to enhance management oversight and improve transparency by separating management oversight and business execution functions, it is a structure that makes it possible to strive to expedite the decision-making process by broadly delegating authority for the execution of business functions from the Board of Directors to the Executive Officers.

At the Company, which is a Company with Three Board Committees where management oversight and business execution functions are institutionally separated, in addition to the Board of Directors and the Nomination/Audit/Compensation committees, which are the three statutory committees, both the "Board Risk Committee", which is a committee that has the purpose of deepening the oversight of risk management by the Board of Directors and the "Outside Directors Meeting" for having Outside Directors periodically engage in discussions regarding matters concerning the Company's business and corporate governance, have been established.

Corporate Governance System

as of June 24, 2025

The main role of the Company's Board of Directors is management oversight and the purpose of the Board of Directors of the Company is to strive for the Company's sustainable growth and maximization of corporate value over the mid to long-term. The Board of Directors, in addition to ensuring the fairness and transparency of the management, determines the "Fundamental Management Policy," and appointments of Executive Officers that manage the Company such as the Group CEO and important business execution decisions are made based on such policy.

The Board of Directors of the Company, to enable active discussion from diversified perspectives, consists of members with diversity, such as in gender, international experience and work experience, and with expertise in areas such as accounting, corporate management, and law, etc., as a general rule. Further, for the appropriate exercise of the Board of Directors' management oversight functions, there is a general rule that the majority of the Board of Directors must be Outside Directors.

The Board of Directors is chaired by a Director who is not concurrently serving as an Executive Officer, allowing the Board of Directors to concentrate on overseeing the business conducted by the Executive Officers.

We have established Independence Criteria for Outside Directors (PDF 132KB) within the Nomination Committee to ensure the independence of Outside Directors from Nomura Group. As none of the eight Outside Directors of Nomura Holdings fall under the categories for which independence is considered questionable, we have reported that each of the Outside Directors is an independent Director in our submission to the Tokyo Stock Exchange.

Composition of the Board of Directors (as of June 24, 2025)

- Please scroll horizontally to look at table below.

|

Name |

Positions |

Skill |

|||||||

|

Corporate Management |

International Business |

Financial Industry |

Accounting/ Financial |

Legal Systems/ Regulations |

Internal Control (Including Risk Management) |

Digital (IT)・DX |

Sustainability |

||

|

Koji Nagai |

Non-Executive Director (Chairman of the Board of Directors) |

〇 |

〇 |

〇 |

〇 |

||||

|

Kentaro Okuda |

Represen tative Executive Officer, President Group CEO |

〇 |

〇 |

〇 |

〇 |

||||

|

Yutaka Nakajima |

Represen tative Executive Officer and Deputy President |

〇 |

〇 |

〇 |

〇 |

||||

|

Shoji Ogawa |

Non-Executive Director |

〇 |

〇 |

〇 |

|||||

|

Victor Chu |

Outside Director |

〇 |

〇 |

〇 |

〇 |

〇 |

〇 |

||

|

J. Christopher Giancarlo |

Outside Director |

〇 |

〇 |

〇 |

〇 |

〇 |

〇 |

||

|

Patricia Mosser |

Outside Director |

〇 |

〇 |

〇 |

〇 |

〇 |

|||

|

Takahisa Takahara |

Outside Director |

〇 |

〇 |

〇 |

|||||

|

Miyuki Ishiguro |

Outside Director |

〇 |

〇 |

||||||

|

Masahiro Ishizuka |

Outside Director |

〇 |

〇 |

||||||

|

Taku Oshima |

Outside Director |

〇 |

〇 |

〇 |

|||||

|

Nellie Liang |

Outside Director |

〇 |

〇 |

〇 |

〇 |

〇 |

|||

The Company has established an Office of Non-Executive Directors and Audit Committee to support the work of the Audit Committee and the Board of Directors. The office acts as the secretariat of the Audit Committee and supports Directors in the performance of their duties by such means as regularly providing information on management to Outside Directors.

In connection with meetings of the Board of Directors, the Company, by using occasions such as briefings prior to Meetings of the Board of Directors, continuously provides updates to Outside Directors regarding important matters of the Company, including business content, business plans, financial status, and governance structures such as the internal controls system.

In addition, an Outside Director may request an explanation or report and/or request materials from Executive Officers and employees as necessary. An Outside Director may consult legal, accounting, or other outside experts at the Company's expense, as necessary.

Separate from Board of Directors meetings, meetings comprising only Outside Directors are held, where matters such as the strategy of Nomura Group and the management of the Board of Directors are discussed to help strengthen the oversight function.

|

Number of Meetings of Board of Directors |

11 (from April 1, 2024 to March 31, 2025) |

Specific deliberations of the Board of Directors for the fiscal year ended March 31, 2024

|

Key Deliberations |

|

|

Project 2030 |

Nomura Group’s strategic direction, basic guidelines for resource allocation, and milestone quantitative targets, etc. for FY2030/31 |

|

Future Strategies of Wealth Management Division |

Future direction, Business model to be aimed, and Plan for achieving the management vision, etc. |

|

Future Strategies of Wholesale Division |

Wholesale Platform Delivering Progress, and estimated risks for Plan 2030, etc. |

|

Future Strategies of Investment Management Division |

Current situation, Themes to achieve aims, and Inorganic Strategy/Strengthening Governance, etc. |

|

Business Strategy of Banking Division |

Other companies’ strategies and trends, and Nomura Group’s banking and trust business strategies toward 2030, and points of differentiation, etc. |

|

Action to implement management that is conscious of cost of capital and stock price |

Nomura’s Cost of Equity, initiatives to improve corporate value (ROE), progress in the last fiscal year, and disclosure in the Nomura Report 2024, etc. |

|

Resource Allocation |

Nomura Group’s direction of business portfolio heading to 2030, concept of capital capacity, and impact of Basel III finalization, etc. |

|

FY2025/26 Budget and Business Strategy |

Approach to the Budget Planning, and Business Strategy of each Division, etc. |

|

Compliance related report |

Contents, background, future plans and measures to prevent a recurrence regarding recommendation for Administrative Monetary Penalty Payment Order to Nomura Securities Co., Ltd. by the Securities and Exchange Surveillance Commission, etc. |

|

Progress on Response of the Incidents |

Progress on Measures to Prevent Recurrence of Penalty Payment Cases and Response Measures Regarding Former Employee Incident, etc. |

|

Dialogues with shareholders and investors |

Status of the dialogues with shareholders and investors, results of exercising voting rights, points of exercising voting rights in 2025, and IR strategic plan and activities schedule, etc. |

|

Investor Day |

Further enhancing corporate value: The road to 2030, and Underpinnings of higher corporate value, etc. |

|

IT Human Resources Strategy |

Japan IT target model and human resource strategies, and approach for IT resource hiring, etc. |

|

Sustainability related report |

Initiatives for the first half of FY2024/25 (Enhancing information disclosure, establishing Green Bond Issuance Framework and establishing a system for monitoring net zero targets, etc.), and future direction, etc. |

|

Report of Investment Securities Committee |

Status of deliberations of the Investment Securities Committee, and status of holdings and sales of Investment Securities, etc. |

|

Report on the Board Effectiveness Evaluation |

Initiatives for enhancing the Board effectiveness implemented in FY2024/25, etc.* |

- Concerning matters regarding the Board Effectiveness Evaluation, discussions were also held at Outside Directors Meetings in addition to the Board of Directors. The latest result of the Board Effectiveness Evaluation is disclosed at "Corporate Governance Report" of the Company.

-

Corporate Governance Report

(912KB)

Corporate Governance Report

(912KB)

We have been conducting evaluations on the effectiveness of the Board of Directors since the fiscal year ended March 2016. Each Director assesses the management of the Board of Directors, including the quantity and quality of information offered and discussions by the Board of Directors. Based on those results, they also share their findings at Board of Directors Meetings as well as Outside Directors Meetings, and further discuss about issues found with other Directors including Executive Officers in order to continue strengthening their oversight function.

Through evaluation of these discussions and findings, the Board of Directors found the effectiveness of Board of Directors is generally at an almost good level this year as well. As a company with Three Board Committees structure, we ensure to accelerate the Group's decisionmaking process, and we are enhancing the ability to utilize of all members' expertise either during or outside of Board of Directors Meetings, to further enrich the function of the Board of Directors.

|

Evaluation Items |

|

|

Response to Results |

In response to the result of FY 2024 effectiveness evaluation, the management vision (Reaching for Sustainable Growth) for 2030 was formulated through discussions at the Board of Directors in FY 2025. Additionally, a full-time senior managing director in charge of investor relations was appointed and the structure of the department in charge was strengthened. Furthermore, the Board of Directors continued to take measures, such as receiving multiple reports on our sustainability initiatives, to fully exercise its supervisory function. In the FY 2025 effectiveness evaluation, a high level of evaluation continues to be maintained overall, including items related to the nomination, audit, and compensation committee with the newly appointed Chairman. There were many opinions appreciating points such as contribution to the improvement of corporate value, composition of the members of the Board of Directors, and efforts to enhance deliberations by selecting agenda items and improving reporting efficiency. Furthermore, for the purpose of realizing the further enhancement of functions of the Board of Directors, the following challenges, such as monitoring of management benchmarks and enhancement of dialogue with stakeholders, were mentioned. Based on the results of the FY 2025 effectiveness evaluation, initiatives to exercise the appropriate monitoring function through the agenda setting relating to mid- to long-term management strategies and advancement of meeting management, in order to further enhance the management supervision function of the Board of Directors, are being implemented. Including on the basis of these initiatives, the Board of Directors’ evaluation is that the effectiveness of the Board of Directors is fully secured. |

Nomination Committee

This Committee determines the details of any proposals concerning the election and dismissal of Directors to be submitted to general meetings of shareholders based on determined standards relating to personality, insight, ethics, expertise and experience in corporate management independence and others.

The current members of this Committee are: Outside Directors Taku Oshima, Takahisa Takahara, and Miyuki Ishiguro. This Committee is chaired by Taku Oshima.

Audit Committee

This Committee (i) audits the execution by the Directors and Executive Officers of their duties and the preparation of audit reports and (ii) determines the details of proposals concerning the election, dismissal, and non-reappointment of the independent auditors to be submitted to general meetings of shareholders.

The current members of the Committee are: Outside Directors Masahiro Ishizuka and Victor Chu and a Director not concurrently serving as an Executive Officer and a full-time member, Shoji Ogawa. All committee members satisfy requirements for independence in accordance with the Sarbanes-Oxley Act of 2002. This Committee is chaired by Masahiro Ishizuka. Masahiro Ishizuka is Financial Expert under this Act and has comprehensive knowledge in the areas of finance and accounting.

Compensation Committee

This Committee determines the Company's policy with respect to the determination of the details of each Director and Executive Officer's compensation. The committee also determines the details of each Director and Executive Officer's actual compensation. The current members of this committee are: Outside Directors Taku Oshima, Takahisa Takahara, and Miyuki Ishiguro. This Committee is chaired by Taku Oshima.

Board Risk Committee

The Board Risk Committee is a non-statutory organ, of which purpose is to assist the Board of Directors in supervising Nomura Group's risk management and to contribute to sophistication of the risk management. The current members of this committee are: Outside Directors Patricia Mosser, J. Christopher Giancarlo, Miyuki Ishiguro, Nellie Liang and Shoji Ogawa, a Director not concurrently serving as an Executive Officer. This Committee is chaired by Patricia Mosser.

As of end of March, 2025

|

Chairman |

Ratio of Outside Directors |

No. of Times Held (Average Attendance Rate) |

|

|

Board of Directors |

Non-Executive Directors |

67% |

11 (100%) |

|

Nomination Committee |

Outside Directors |

67% |

6 (100%) |

|

Compensation Committee |

Outside Directors |

67% |

6 (100%) |

|

Audit Committee |

Outside Directors |

67% |

14 (95%) |

|

Board Risk Committee |

Outside Directors |

80% |

5 (100%) |

As a Company with Three Board Committees, the Board of Directors has, to the extent permitted by laws and regulations, delegated to the Executive Officers decision making authority for business execution functions to ensure that the Executive Officers can execute the Company's business with speed and efficiency. Among the matters delegated to the Executive Officers by resolutions adopted by the Board of Directors, the most important matters of business must be decided upon deliberation by specific management bodies within the Company including the Executive Management Board, the Group Risk Management Committee, the Nomura Group Conduct Committee and the Sustainability Committee. The Board of Directors is to receive reports on the status of the deliberations at the Executive Management Board, etc. by each management body as appropriate.

In order to further bolster our business execution framework for financial operations that are becoming increasingly sophisticated and specialized, we utilize a system whereby the Executive Officers delegate a part of their authority for business execution decisions to Senior Managing Directors, who focus on individual business and operations.