*X, formerly Twitter share button is not available on your current browser.

BOOSTRY Releases Japan Security Token Market Report (FY2023)

April 2, 2024

BOOSTRY Co., Ltd.

BOOSTRY Co., Ltd today announced that it has released the Japan Security Token Market Report for FY2023.

In FY2023, the Japanese Security Token Market saw a rapid increase in issuance value and a diversification of products and the financial institutions handling them, confirming that the market has moved from the proof of concept stage to practical use. This also shows that security tokens have been established as a new financing method in the capital markets.

The total issuance amount and merchantability are expected to continue to increase in FY2024. In addition, "ibet for Fin," a consortium-type blockchain network, earned the top market share for blockchain infrastructure, supporting transactions and management in the security token market.

Below is an overview of the report findings. Refer to BOOSTRY BLOG for more details.

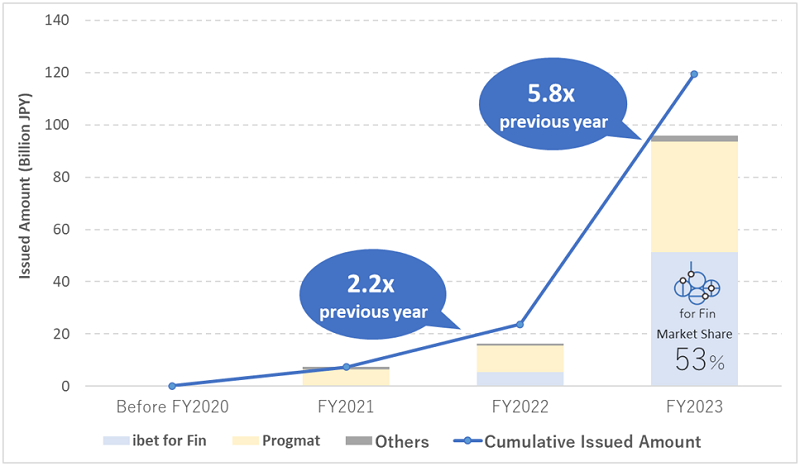

Total issuance in FY2023 exceeded JPY90 billion, 5.8x growth YoY

The total issuance amount of security tokens in Japan in FY2023 was JPY 97.6 billion, a 5.8x increase from the previous year. This represents 16% of annual issuance in the Japanese stock market and 31% of annual issuance in the listed REIT market, making it a significant portion of the capital markets. In FY2023, there were three large issues of JPY 10 billion or more for the first time. With the increase in the amount of funding raised by security tokens, the market has developed to meet a variety of financing needs.

Figure 1: Annual domestic security token issuance (Public Offering) amounts by blockchain infrastructure

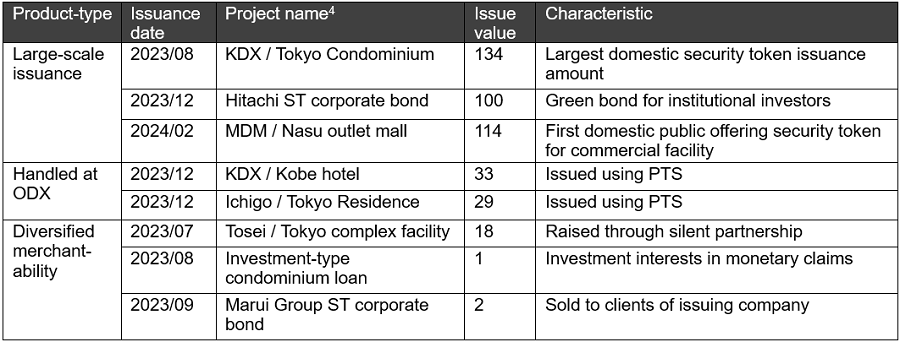

Product line consists of 85% real estate beneficiary certificate issuance trusts, and 13% corporate bonds. New initiatives are also expanding.

As for product breakdown, beneficiary certificate issuance trusts accounted for the largest share at 85% (JPY 82.5 billion), followed by corporate bonds at 13% (JPY 13.2 billion). Although the issuance amount of private placements was not disclosed in most cases, there were moves toward diversification of product features to meet various financing needs, such as securitization through silent partnerships, and security tokens using limited liability partnerships for investment.

In addition, the issuance of a large digitally tracked green bond for institutional investors in the form of security token corporate bonds paved the way for institutional investors to participate in the security token market. With regard to real estate beneficiary certificate issuance trusts, trading was initiated through exchanges using private trading systems (PTS).

Table 1: Representative projects for FY2023

Financial institutions handling the security tokens include 11 brokerage firms, etc., 6 banks/trust banks, and 9 asset management companies

Security tokens were handled by 11 distribution firms (brokerage firms /registered financial institutions; +5 YoY) and six trustees/ bond administrators (banks/trust banks; +2 YoY). While real estate beneficiary certificate issuance trusts were biased toward certain trust banks until FY2022, the number of trust banks handling such issues increased in FY2023 as the number of deals expanded to include large issues and issues handled by PTS.

The number of companies involved in the issuance of securitized products increased to four corporate bond issuers (+1 YoY), six asset management companies involved in trusts issuing beneficiary certificates (+3 YoY), and three asset management companies involved with other products (+1 YoY). The number of asset management companies involved in securitized products also increased.

ibet for Fin topped the blockchain infrastructure market share at 53%, followed by Progmat at 45%

For public offerings, ibet for Fin had the top share of blockchain infrastructure supporting the trading and management of security tokens at 53% (based on issuance amount: JPY 51.6 billion) in FY2023.

The ibet for Fin consortium is the only consortium-type security token network in Japan. As of April 1, 2024, it is jointly operated by 18 major Japanese financial institutions, a structure that does not allow any one company to monopolize it, including BOOSTRY. It has been in operation since April 2021 and is the only shared blockchain platform that allows multiple securities companies, banks and trust banks to freely handle various financial products, while also allowing IT companies and other companies that provide services supporting security tokens to freely develop their businesses.

Progmat, a blockchain platform used by Mitsubishi UFJ Trust and Banking Corporation, has a 45% share (based on issuance amount: JPY 43.8 billion), ranking first in real estate beneficiary certificates issuance trusts with 14 issuances. Hash DasH and Securitize had JPY 1.8 billion in issuances, and Securitize had JPY 0.3 billion yen.

Future prospects

During FY2023, the use of security tokens transitioned from proof of concept to practical use. The amount of issuance, merchantability, and number of financial institutions handling security tokens are expected to continue expanding in FY2024. In conjunction with practical use, platforms such as ibet for Fin and public-type blockchain that take advantage of the characteristics of blockchain and cannot be monopolized by specific companies, are expected to grow.

In FY2024, BOOSTRY believes that there will be fundraising transactions and new investment experiences that are only possible with security tokens, demonstrating the value of security tokens.

- Amounts for real estate securitization products exclude funding through loans. Amounts rounded down to the nearest 100 million; share percentages rounded off.

- Total amount of funding raised by listed companies in 2023, announced by Japan Exchange Group, was approx. ¥588.7 billion through public offering (Source: https://www.jpx.co.jp/markets/statistics-equities/misc/06.html)

- Total amount of funding raised by J-REIT in 2023, announced by The Association for Real Estate Securitization, was approx. ¥312.9 billion through public offering (Source: https://j-reit.jp/statistics)

- For real estate backed security tokens, project name includes asset management company/overview of underlying real estate. KDX and MDM refer to Kenedix, Inc. and Mitsui & Co. Digital Asset Management, Ltd., respectively. Ichigo and Tosei refer to Ichigo Investment Advisors Co., Ltd. and Tosei Asset Advisors, Inc., respectively.