*Twitter share button is not available on your current browser.

Terms and Conditions as Determined by Japan Exchange Group for the Issuance of the Digitally Tracked Green Bonds, the First Digital Green Bonds in Japan

June 1, 2022

Japan Exchange Group, Inc.

Hitachi, Ltd.

Nomura Securities Co., Ltd.

BOOSTRY Co., Ltd.

Japan Exchange Group, Inc. (JPX; Director & Representative Executive Officer, Group CEO: Akira Kiyota) announces its decision made on the condition of issuing the 1st Unsecured Bonds (with special pari passu clause among specified bonds and transfer restrictions) (Digitally Tracked Green Bond,) the corporate bond-type security tokens that utilize a blockchain platform (hereinafter, the "digital bond,") as follows.

The Digitally Tracked Green Bonds are the first green bonds in Japan that will use a digital scheme that is currently being developed in close cooperation by four companies: JPX, Hitachi, Ltd. (Hitachi: President & CEO: Keiji Kojima), Nomura Securities Co., Ltd. (Nomura: Representative Director, President: Kentaro Okuda), and BOOSTRY Co., Ltd. (BOOSTRY: Representative Director and CEO: Toshinori Sasaki.) These four companies strive to provide greater convenience and will reflect the opinions offered by investors through this issuance in developing the functions of the Digitally Tracked Green Bonds and enhancing the system.

In addition, we announce that investors listed below informed us of their interest in investing in the digital bond.

The 1st Unsecured Bonds (with special pari passu clause among specified bonds and transfer restrictions) (Digitally Tracked Green Bond)

| Total bond amount | JPY500 million |

| Amount per bond | JPY100 million |

| Coupon | 0.050% annually |

| Paid-in amount | JPY100 per JPY100 of each bond |

| Redemption amount | JPY100 per JPY100 of each bond |

| Maturity term | One year |

| Redemption Date | June 3, 2023 |

| Method of soliciting bond subscription | Public solicitation in Japan |

| Payment Date | June 3, 2022 |

| Usage of funds raised | JPX will appropriate funds procured through the issuance of the Digitally Tracked Green Bonds for a loan to JPX Market Innovation & Research, Inc. (JPXI: President & CEO: Miyahara Koichiro), which JPXI will appropriate for the capital investment in power generation facilities using the renewable energy resources (solar power and biomass power generation facilities) under green projects. |

| Underwriter | Nomura Securities Co., Ltd. |

| Digital Structuring Agent *1 and Green Bond Structuring Agent *2 | Nomura Securities Co., Ltd. |

| Agent Treasurer | The Nomura Trust and Banking Co., Ltd. |

| Administrator of bond registry | The Nomura Trust and Banking Co., Ltd. |

| Second-party opinion | We received a second-party opinion on the digital bonds’ qualification as green bonds from Rating and Investment Information, Inc. (R&I,) a third-party assessment body. |

| Bond rating | None |

1. A party who supports the issuance of the digital bonds with advice, etc., on blockchain

2. A party who supports the issuance of the green bonds with advice, etc., on establishing the green bond framework and obtaining external assessment

Initiatives for the Digitally Tracked Green Bonds

We consider the following to be the issues surrounding green bond investment for both issuers and investors.

| Issuers | Investors |

|---|---|

|

The complexities of obtaining green finance indicators such as CO2 reductions through green projects include:

As a result, higher management cost incurs compared with ordinary bonds. |

Functions to obtain information for monitoring green projects are limited from the following viewpoints:

It is difficult to make cross-comparisons among investees due to the following:

|

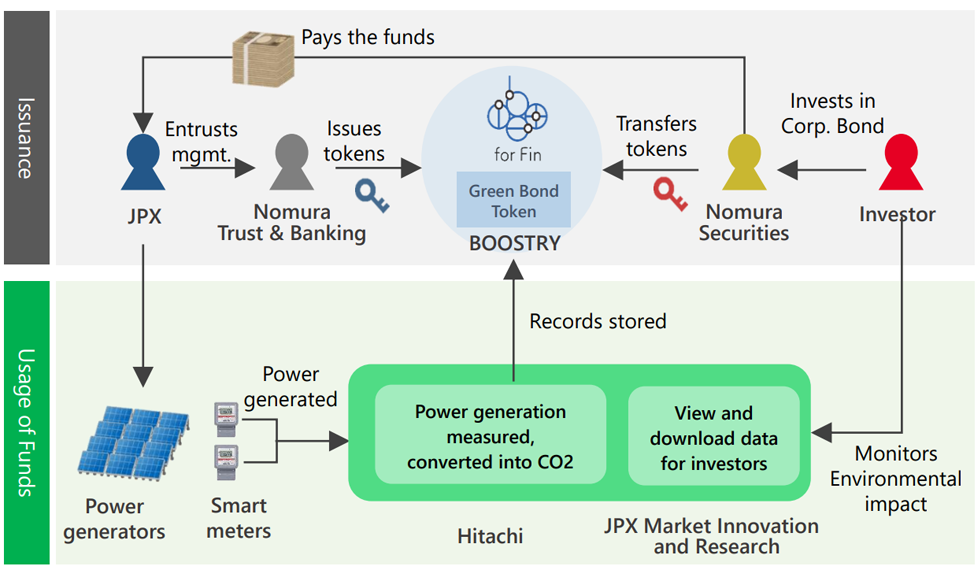

To solve these issues, the four companies, JPX, Hitachi, Nomura, and BOOSTRY, have undertaken the development of the Digitally Tracked Green Bonds.

The scheme will allow issuers to obtain green finance indicators, such as power generation volume and CO2 reduction volume, from green power generation facilities without the issuer’s involvement, and will solve issues surrounding the burdens and complexities of connecting operation systems among issuers.

By making it possible to visualize data obtained on green finance indicators and to view and download that data at any time, we will be able to improve the transparency of green projects and make monitoring and other tasks more efficient for investors. A new system developed by Hitachi and JPXI will implement the collection and visualization of data so that investors can check the green finance indicators as they wish without time constraints.

These Digitally Tracked Green Bonds schemes aim to increase the transparency of green investment data and convenience for parties concerned.

Outline of the Digitally Tracked Green Bonds Scheme

Ms. Yuriko Fujita, Line Manager in the Fixed Income Investment Department of The Dai-ichi Life Insurance Company, Limited offered her comments to convey their interest in the investment as follows.

“The Dai-ichi Life Insurance Company Limited (the Company) appreciates this advanced initiative as the Company focuses on digital technologies such as blockchain used for the Bonds and considers that the initiative has potential for future digital technologies that will be utilized more extensively in business, including the data visualization of and continuous access to green financial data.”

In developing the digital tracking function, we will seek the opinion of The Dai-ichi Life Insurance Company, Limited, who will act as a user of the monitoring screen for investor use, as well as other tools. Together with investors, we will take their opinions into consideration in order to make the Digitally Tracked Green Bonds more convenient.

JPX hopes many issuers and investors will be able to participate in this scheme with greater convenience going forward. JPX welcomes those interested in this scheme, from issuers to investors and financial institutions. Please get in touch with the contact office listed below for any inquiries.

“Cooperation in the Issuance of Japan's First Wholesale Digitally Tracked Green Bond” announced April 15, 2022

Cooperation in the Issuance of Japan's First Wholesale Digitally Tracked Green BondDisclaimers

When bonds are purchased via public offerings, secondary distributions, or other OTC transactions with Nomura Securities, only the purchase price shall be paid, with no sales commission charged. Bonds carry the risk of losses, as prices fluctuate in line with changes in market interest rates. Bond prices may also fall below the invested principal as a result of such factors as changes in the management and financial circumstances of the issuer, or changes in third-party valuations of the bond in question.

Nomura Securities Co., Ltd.

Financial instruments firm registered with the Kanto Local Finance Bureau (registration No. 142)

Member associations: Japan Securities Dealers Association; Japan Investment Advisers Association; The Financial Futures Association of Japan; and Type II Financial Instruments Firms Association.

Nomura

Nomura is a global financial services group with an integrated network spanning over 30 countries and regions. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Wholesale (Global Markets and Investment Banking), and Investment Management. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.