*Twitter share button is not available on your current browser.

Cooperation in the Issuance of Hitachi's Digital Green Bond

November 16, 2023

Hitachi, Ltd.

JPX Market Innovation & Research, Inc.

Nomura Securities Co., Ltd.

BOOSTRY Co., Ltd.

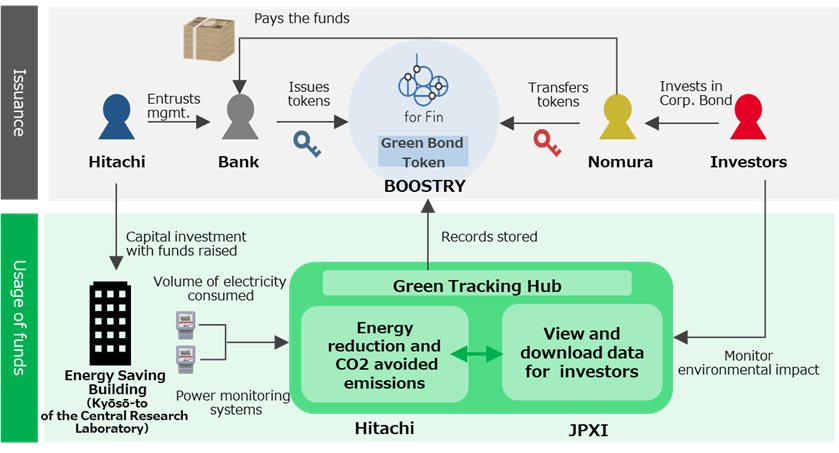

Tokyo, November 16, 2023 - Hitachi, Ltd. ("Hitachi"), JPX Market Innovation & Research, Inc. ("JPXI"), Nomura Securities Co., Ltd. ("Nomura"), and BOOSTRY Co., Ltd. ("BOOSTRY"), are cooperating with Hitachi toward its issuance of a "Digitally Tracked Green Bond" ("digital green bond") utilizing digital technologies such as IoT and a blockchain platform. The terms of issuance shall be announced once they have been decided.

The digital green bond is a bond aimed at utilizing digital technologies to improve the transparency of data needed for green investment and the efficacy of gathering that data. The bond will have a corporate bond-type security tokens ("digital bond") scheme that utilizes a Green Tracking Hub jointly developed by Hitachi and JPXI allowing investors to easily view the bond's environmental effect, and a blockchain provided by BOOSTRY. In addition, the digital green bond is the second issuance in Japan, following Japan Exchange Group, Inc.

The four companies will continue to promote the issuance of digital green bonds following this issuance by Hitachi, and by making these bonds available to a wide range of issuers and investors, contribute to carbon neutrality in society.

Illustration of the digital green bond scheme

1. Use of Proceeds

Hitachi plans to allocate the funds raised through the issuance of the digital green bond as its effort to achieve carbon neutrality by FY2030 at business sites (factories and offices) to refinance expenditures of the construction and refurbishment of Kyōsō-to of the Central Research Laboratory (energy saving building), which was completed in March 2019 and achieved carbon neutrality in FY2021.

2. Characteristics of the Initiative

- Digital bond

The digital bond will be in the form of a publicly offered STO (Security Token Offering) issued by Hitachi. An STO is a scheme to raise funds using "security tokens", which are tokens issued by electronic means such as blockchain that represent stocks, bonds, or other securities, in place of conventional securities. - Digital green bond

Being able to measure the effects of invested projects on the environment and society, and represent these with comparable metrics, is considered very beneficial to the green and other ESG bond markets.

Hitachi has obtained a second-party opinion regarding its green bond framework from Rating and Investment Information, Inc. (R&I) for the issuance of the digital green bond.

3. Outline of the Platform for Issuing Digital Bond

The digital bond will be issued and administered through a consortium-type blockchain network, "ibet for Fin"*1, led by BOOSTRY, instead of the normal book-entry transfer by the Japan Securities Depository Center. Operational processes will be completed electronically, from issuance to administration during the bond's term and redemption. Using ibet for Fin will enable the management of a bond registry as well as allowing issuers to keep track of bond holders on an ongoing basis, which is difficult with conventional bonds.

4. Overview of the Green Tracking Hub

To raise the transparency of the use of proceeds raised through the digital green bond, Hitachi will utilize the Green Tracking Hub jointly developed by Hitachi and JPXI that automatically measures the volume of electricity consumed at the buildings, to which funds were allocated, and converts the volume into a comparison of volume of CO2 avoided emissions and energy reduction versus benchmarks, and discloses this data to investors. By enabling monitoring by investors at any time, Hitachi aims for transparency on a higher level than just annual reporting. In addition, sharing data with BOOSTRY and recording the energy reduction and CO2 avoided emissions on ibet for Fin will enhance data transparency and timeliness.

In addition to collecting data from previous renewable energy facilities, the Green Tracking Hub will collect data from the building to which funds from this bond will be allocated. Hitachi plans to continually expand its green assets subject to data collection going forward.

Furthermore, Hitachi plans to leverage the Green Tracking Hub's mechanism to improve transparency of environmental effect of green projects to expand its usage to cover automation of the issuance and authentication of carbon credits, support for carbon offsetting by business corporations, and more.

5. The Roles of Each Company

The four companies will cooperate as below while aiming to contribute to carbon neutrality in society as a whole by sharing lessons learned from and issues identified during this initiative.

| Company | Major Roles |

|---|---|

| Hitachi |

|

| JPXI |

|

| Nomura |

|

| BOOSTRY |

|

1 Please view the ibet for Fin website, run by BOOSTRY (Japanese only). ibet For Fin コンソーシアム|BOOSTRY

2 Part of a platform offered by Hitachi to promote sustainable finance. Leverages IoT and blockchain to securely collect operational data on facilities in portfolio projects and automate the monitoring/reporting process (Japanese only).

Accelerate Investments in Sustainable Finance: A Digital Platform for Green Bonds : Research & Development : Hitachi

3 An entity which supports the issuance of digital green bonds by originating schemes and advising impact reporting using digital technologies, distribution to investors, required documentation, and more.

About Hitachi, Ltd.

Hitachi drives Social Innovation Business, creating a sustainable society through the use of data and technology. We solve customers' and society's challenges with Lumada solutions leveraging IT, OT (Operational Technology) and products. Hitachi operates under the business structure of "Digital Systems & Services" - supporting our customers' digital transformation; "Green Energy & Mobility" - contributing to a decarbonized society through energy and railway systems, and "Connective Industries" - connecting products through digital technology to provide solutions in various industries. Driven by Digital, Green, and Innovation, we aim for growth through co-creation with our customers. The company's consolidated revenues for fiscal year 2022 (ended March 31, 2023) totaled 10,881.1 billion yen, with 696 consolidated subsidiaries and approximately 320,000 employees worldwide. For more information on Hitachi, please visit the company's website at Hitachi Global.

About JPX Market Innovation & Research

JPX Market Innovation & Research was established as a new subsidiary of Japan Exchange Group, Inc. to stand alongside its exchange, regulatory, and clearing entities, and started business on April 1, 2022. It aims to create market services to improve the functionality and efficiency of the overall financial instruments market. JPX Market Innovation & Research goes beyond the bounds of traditional financial instruments exchanges to aim for flexible and agile business development leveraging M&As, industry-leading talent, and more, enhance digital business and network business using data and technology, and promote the diversification of business and improvement of services.

For more information on Japan Exchange Group, please visit the company's website at About JPX | Japan Exchange Group

About Nomura Group

Nomura is a global financial services group with an integrated network spanning approximately 30 countries and regions. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Investment Management, and Wholesale (Global Markets and Investment Banking). Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.

About BOOSTRY

Based on its mission of "connecting challengers and supporters by making all rights transferrable and usable" BOOSTRY provides various IT services to enable the distribution of rights. BOOSTRY leads in the development of "ibet for Fin," Japan's only consortium-based blockchain platform freely usable by various financial institutions in the capital market. BOOSTRY aims to expand the existing capital market by forming a security token ecosystem with a platform that cannot be monopolized by it or any other business. For details, please view BOOSTRY's website (Japanese only) (BOOSTRY - Boost your try.)

Business Contact:

JPX Market Innovation & Research, Inc.

Tel: +81-3-3666-1361

BOOSTRY Co., Ltd.

Inquiry e-mail: ibet-support@boostry.co.jp

Note: This news release does not constitute an offer of any securities for sale in any jurisdiction. This news release has been prepared for the sole purpose of publicly announcing the cooperation in the issuance of Hitachi's digital green bond and not for the purpose of soliciting investment or engaging in any other similar activities within or outside Japan. The securities referred to above have not been and will not be registered under the United States Securities Act of 1933, as amended (the "Securities Act") and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Cautionary Statement

Certain statements found in this document may constitute "forward-looking statements" as defined in the U.S. Private Securities Litigation Reform Act of 1995. Such "forward-looking statements" reflect management's current views with respect to certain future events and financial performance and include any statement that does not directly relate to any historical or current fact. Words such as "anticipate," "believe," "expect," "estimate," "forecast," "intend," "plan," "project" and similar expressions which indicate future events and trends may identify "forward-looking statements." Such statements are based on currently available information and are subject to various risks and uncertainties that could cause actual results to differ materially from those projected or implied in the "forward-looking statements" and from historical trends. Certain "forward-looking statements" are based upon current assumptions of future events which may not prove to be accurate. Undue reliance should not be placed on "forward-looking statements," as such statements speak only as of the date of this report.

Factors that could cause actual results to differ materially from those projected or implied in any "forward-looking statement" and from historical trends include, but are not limited to:

- Economic conditions, including consumer spending and plant and equipment investment in Hitachi's major markets, as well as levels of demand in the major industrial sectors Hitachi serves;

- Exchange rate fluctuations of the yen against other currencies in which Hitachi makes significant sales or in which Hitachi's assets and liabilities are denominated;

- Uncertainty as to Hitachi's ability to access, or access on favorable terms, liquidity or long-term financing;

- Uncertainty as to general market price levels for equity securities, declines in which may require Hitachi to write down equity securities that it holds;

- Fluctuations in the price of raw materials including, without limitation, petroleum and other materials, such as copper, steel, aluminum, synthetic resins, rare metals and rare-earth minerals, or shortages of materials, parts and components;

- Credit conditions of Hitachi's customers and suppliers;

- General socioeconomic and political conditions and the regulatory and trade environment of countries where Hitachi conducts business, particularly Japan, Asia, the United States and Europe, including, without limitation, direct or indirect restrictions by other nations on imports and differences in commercial and business customs including, without limitation, contract terms and conditions and labor relations;

- Uncertainty as to Hitachi's ability to response to tightening of regulations to prevent climate change;

- Uncertainty as to Hitachi's ability to maintain the integrity of its information systems, as well as Hitachi's ability to protect its confidential information or that of its customers;

- Uncertainty as to Hitachi's ability to attract and retain skilled personnel;

- Uncertainty as to Hitachi's ability to continue to develop and market products that incorporate new technologies on a timely and cost-effective basis and to achieve market acceptance for such products;

- Exacerbation of social and economic impacts of the spread of COVID-19;

- The possibility of disruption of Hitachi's operations by natural disasters such as earthquakes and tsunamis, the spread of infectious diseases, and geopolitical and social instability such as terrorism and conflict;

- Estimates, fluctuations in cost and cancellation of long-term projects for which Hitachi uses the percentage-of-completion method to recognize revenue from sales;

- Increased commoditization of and intensifying price competition for products;

- Fluctuations in demand of products, etc. and industry capacity;

- Uncertainty as to Hitachi's ability to implement measures to reduce the potential negative impact of fluctuations in demand of products, etc., exchange rates and/or price of raw materials or shortages of materials, parts and components;

- Uncertainty as to the success of cost structure overhaul;

- Uncertainty as to Hitachi's ability to achieve the anticipated benefits of its strategy to strengthen its Social Innovation Business;

- Uncertainty as to the success of acquisitions of other companies, joint ventures and strategic alliances and the possibility of incurring related expenses;

- Uncertainty as to the success of restructuring efforts to improve management efficiency by divesting or otherwise exiting underperforming businesses and to strengthen competitiveness;

- The potential for significant losses on Hitachi's investments in equity-method associates and joint ventures;

- Uncertainty as to the outcome of litigation, regulatory investigations and other legal proceedings of which the Company, its subsidiaries or its equity-method associates and joint ventures have become or may become parties;

- The possibility of incurring expenses resulting from any defects in products or services of Hitachi;

- Uncertainty as to Hitachi's access to, or ability to protect, certain intellectual property; and

- Uncertainty as to the accuracy of key assumptions Hitachi uses to evaluate its employee benefit-related costs.

The factors listed above are not all-inclusive and are in addition to other factors contained elsewhere in this report and in other materials published by Hitachi.