Investment Management | Strategy for Value Creation

Progress Towards FY2024/25 Target

In the fiscal year ended March 2024, assets under management reached a new record high of 89 trillion yen as inflows continued into a wide range of investment products on the back of favorable market conditions. Business revenue is at its highest level since the division was established in April 2021. We have revised upward KPI targets for the fiscal year ending March 2025 (assets under management and net inflows) and aim to firmly achieve income before income taxes target of 63 billion yen.

Progress/Achievement of KPIs and KGI

* Please scroll horizontally to look at table below.

| March 2024 FY2023/24 (Actual) |

March 2025 FY2024/25 (Target) |

||

|---|---|---|---|

| KPIs | Assets under Management |

¥89 trillion | ¥89 trillion |

| Net inflows | ¥3.8 trillion | ¥3.4 trillion | |

| KGI | Income Before Income Taxes |

¥60.2 billion | ¥63 billion (Announced at Investor Day in May 2023) |

Initiatives for Traditional Asset Businesses

In traditional asset businesses, we are working to grow assets under management and provide high value-added products and services. The "Policy Plan for Promoting Japan as a Leading Asset Management Center" by the Japanese government is a tailwind for our asset management business. In line with the purpose of NISA*1 (Nippon (Japan) Individual Savings Account), we have prepared products that contribute to medium-to-long term asset building for individuals. We have also expanded our product lineup for defined contribution pension plans (DC) and partly because of these efforts, we have captured number one market share among DC dedicated funds.

We will continue to further enhance our approach to asset building generation.

In addition, Nomura Asset Management has been the first in the industry to publish reviews ("Fund Review") in order to be aligned further with the Client-Oriented Business Conduct. Through the self-assessment of products, the review discloses our efforts to improve quality across investment performance, product, and information provision. We will continue to focus our investment resources on high-quality funds and aim to generate competitive investment performance.

Initiatives for Alternative Asset Businesses

As we strategically focus on growing alternative asset businesses, our alternative assets under management at the end of March 2024 increased 47% year on year to approximately 1.9 trillion yen. Leveraging our gatekeeping*2 expertise, we are also providing private asset investment opportunities to individual investors. Our aircraft leasing sales are growing, supported by a recovery in global passenger demand. In Japan, we are also working to scale our in-house private asset management business and expand the real estate fund management business that we launched in April 2023. In addition, we launched a private credit management business in the US.

1 A tax exemption program for small investments by individuals.

2 Gatekeeping is a package solution for alternative investments. For example, we provide the following solutions:

- Introducing funds of external alternative management companies to institutional investors

- Providing advice on selection, through analyzing, evaluating, and conducting due diligence (DD) on investment targets and fund structures

- Entering into discretionary investment contracts and constructing custom-made investments

- Monitoring and fund management for investment decisions and execution

Initiatives for 2030

Where We Aim to Be in FY2030/31

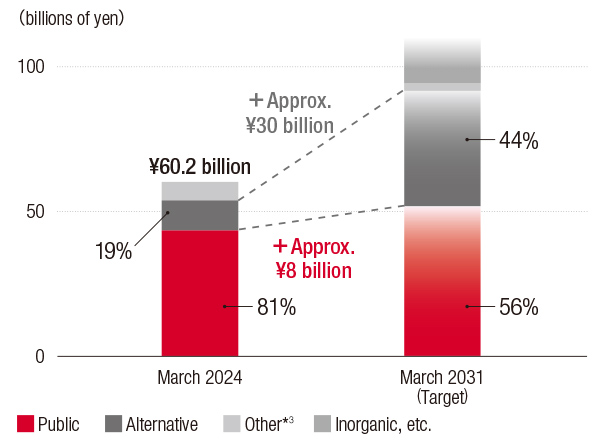

Investment Management Division aims to provide high-quality, high value-added investment products and services. We aim to grow assets under management to approximately 129 trillion yen and expand alternative asset ratio from the current 2% to around 9% in the fiscal year ending March 2031. The competitive environment in the asset management industry is intensifying, and we anticipate management fees for traditional assets to decline further. It is important to strengthen high value-added areas, such as alternative asset management, while expanding total assets under management. Furthermore, we will actively pursue inorganic opportunities that leverage the strengths of our investment management business. Through these efforts, we will aim to achieve income before income taxes of 100 billion yen in the fiscal year ending March 2031.

Themes to Achieve Aims

In order to achieve aims for the fiscal year ending March 2031, we will attempt to grow assets under management and to expand high value-added businesses through the following three themes: "Solutions Capturing Opportunities in Japan,""Creation of Global Value,""New Growth in Collaboration with Global Stakeholders"

Assets Under Management

Income Before Income Taxes

3 Other includes American Century Investments related gain/loss and other gains/losses.

1. Solutions Capturing Opportunities in Japan

In Japan, we will steadily increase our assets under management in areas where further growth is expected such as NISA, DC and exchange-traded funds (ETFs).

We will also capture business opportunities in alternative asset management with relatively higher management fees.

NISA and DC pension plans

The NISA and DC markets are growth areas driven by a series of policies related to the "Doubling Asset-based Income Plan" of the Japanese government. We believe these markets to grow further. To capture growing investment flows in NISA, we will focus on expanding our investor base and assets through following initiatives: providing products across diverse distribution channels nationwide, supporting consulting capabilities of distribution companies, and leveraging media promotion.

In the DC market, we will strengthen our cooperation within the Group to further grow assets and gain market shares.

ETFs

Investors’ holdings of ETFs have been increasing year over year, and there is still considerable room for expansion as an asset management tool, especially in Japan. We will further expand our product lineup and strengthen our marketing strategy to institutional and individual investors.

Alternative investment

Alternative investment by Japanese investors is growing, and we will provide solutions to a wide range of investors by leveraging the strengths of our more than 20 years’ history in the gatekeeping business. We will also scale up in-house management to expand asset classes and products. We will further focus on the "democratization of private investment," which provides individual investors with opportunities to invest in private assets that were previously accessible only to limited institutional investors.

2. Creation of Global Value

Based on our asset management track record and experience gained over many years, we will develop world-class products and enhance investment capabilities to raise awareness globally. As a result, we will increase income before income taxes.

Specialty credit*4

One of the pillars of our global strategy is to strengthen specialty credit management, which is an asset class within active investment that is more likely to generate excess returns. By leveraging our existing strengths in high-yield bond management, we will raise awareness globally as a specialist in credit investment management.

Japan/Asia investment management capabilities

In public markets, we have been providing investment management in Japanese and Asian assets to global investors. We have been highly rated by clients in many investment strategies. Going forward, we will leverage this presence, aiming to launch Japanese private and real asset products for international investors. Also, we will seek to enter private domains in Asian growth markets.

Strengthen and Grow Specialty Credit to Create Value Globally

4 Specialty credit does not refer to high rated and liquid credit such as government bonds and investment-grade corporate bonds of advanced economies, but rather to credit management in more niche areas, such as emerging economies, high-yield bonds, inflation-linked bonds, and private credit. It requires a higher level of expertise than a general credit management. On the other hand, it is considered as an asset class where performance tends to vary depending on the manager.

5 Global dynamic bond fund is managed by Nomura Asset Management's UK base that aims to maximize total returns through an unconstrained strategy that utilizes not only investments in cash bonds but also various investment methods including derivatives.

6, 7 Nomura Alternative Income Fund (NAIF) and Nomura Credit Opportunities Fund (NCOF) are managed by Nomura Capital Management (NCM), a subsidiary of Nomura Holding America Inc., which oversees credit operations in the Americas. Nomura Alternative Income Fund (NAIF) is a closed-end interval fund in the private credit area. It provides investment opportunities targeting a wide range of assets to retail investors in the US, mainly via RIA (A registered investment advisor in the US that provides advice on the formulation of client asset portfolios based on investment advisory contracts concluded with investors). Nomura Credit Opportunities Fund (NCOF) invests in a wide range of opportunities within private credit in the US through executing a strategy that includes joint and secondary investments. The fund primarily provides investment opportunities to institutional investors.Private credit refers to an asset class that includes direct lending, real estate lending, specialty finance, and asset-based lending.

3. New Gowth in Collaboration with Global stakeholders

We will develop and expand high quality investment products that promote a virtuous cycle of investment growth that leads to the resolution of social issues from a global perspective.

We aim to not only further increase income before income taxes, but also to achieve our Group purpose.

Real asset area

In addition to existing aircraft leasing, real estate, and forestry asset management businesses, we will develop new businesses in other real asset areas such as plant factories, renewable energy and new energy.

Research and Development (R&D)

We formed a strategic alliance with Angeleno Group, a venture capital firm providing growth capital for next-generation clean energy. Also, we invested in Teamshares, a US-based company supporting business succession for small and medium-sized companies.

We will further strive to launch new businesses by accumulating expertise and knowledge through these forms of strategic R&D.

Inorganic opportunity

In order to leverage our strengths in investment management businesses, we will continue to pursue inorganic opportunities, not only by examining business domains and valuations, but also by assessing strategic value and corporate culture.