Supporting Japan's Future from ESG S: Social Bonds

With growing interest in ESG investment to solve social issues, we held a conversation between Japan Student Services Organization (the issuer) and The Pack Corporation (the investor), with a focus on "Providing quality education for everyone" (SDG Goal #4) and how they are working toward the same goal. They discussed their approaches and ideas on SDGs.

Participants

| THE PACK CORPORATION | Japan Student Services Organization (JASSO) |

Nomura Securities Co., Ltd. |

|---|---|---|

|

|

|

Aihara:

Today, in the form of an engagement meeting, we would like to hear from the issuer, Japan Student Services Organization (JASSO), and the investor, The Pack Corporation, about their initiatives and views on the SDGs. First, please tell us about the business of The Pack Corporation and its relationship to the SDGs.

Mr. Ouchi:

Established in 1952, The Pack Corporation is a comprehensive packaging manufacturer celebrating our 70th anniversary this year. We mainly handle packaging materials. As for the sales ratio, the paper products business, such as paper bags, paper boxes, and cardboard, accounts for about 69% of sales, the chemical products business, such as shopping bags and plastic bags, accounts for about 14%, and the other business, including the sale of purchased goods, accounts for about 17%. The difference between us and other companies is that we make everything to order. One of the reasons is that we make and provide original packaging that matches our customers' brands and products. I am aware that there are not that many comprehensive package manufacturers like us in Japan. There are companies that handle a wide range of packages through group companies, but I think there are few companies that handle multiple packages in one company and have their own manufacturing facilities to plan, propose, and sell products.

Products handled by The Pack Corporation

Our company has four in-house factories and five group factories as domestic manufacturing bases, but we also conduct OEM production by outsourcing manufacturing to suppliers in Japan and overseas in order to produce what our customers want. When making packages, we are required to faithfully reproduce the structural design and general design that our customers want. However, if we focus on this, we may need manufacturing facilities, so we sometimes have to make a decision. For this reason, we have built a network with suppliers in Japan and overseas to create an environment where we can plan, propose, and manufacture products that meet our customers' needs. One example is cloth bags. Eco-friendly bags became a hot topic as stores began charging for plastic bags, we did not have facilities for manufacturing cloth bags. In response to our customers' requests, we used OEM production to provide them.

Aihara:

I saw that The Pack Corporation's CSR Report includes annual environmental targets, and that the company is working to reduce the environmental impact of its overall production activities, including the procurement of raw materials, manufacturing processes, and waste generation. I also sensed that the company is actively working to protect the natural environment, such as forest conservation activities, as an additional part of its business activities. Could you tell us why you started focusing on environmental initiatives?

Mr. Fujii

The Pack Corporation

Managing Director

Mr. Fujii:

About 70% of our company's sales come from packaging made from paper. Over the past few years, there has been a lot of talk about marine pollution caused by plastic materials, and there has been a shift to paper as a material. Our company also handles plastic materials, but the ratio of plastic materials is decreasing while the ratio of paper is increasing. Since our business is based on paper materials, we want to take care of forests, which are the source of paper.

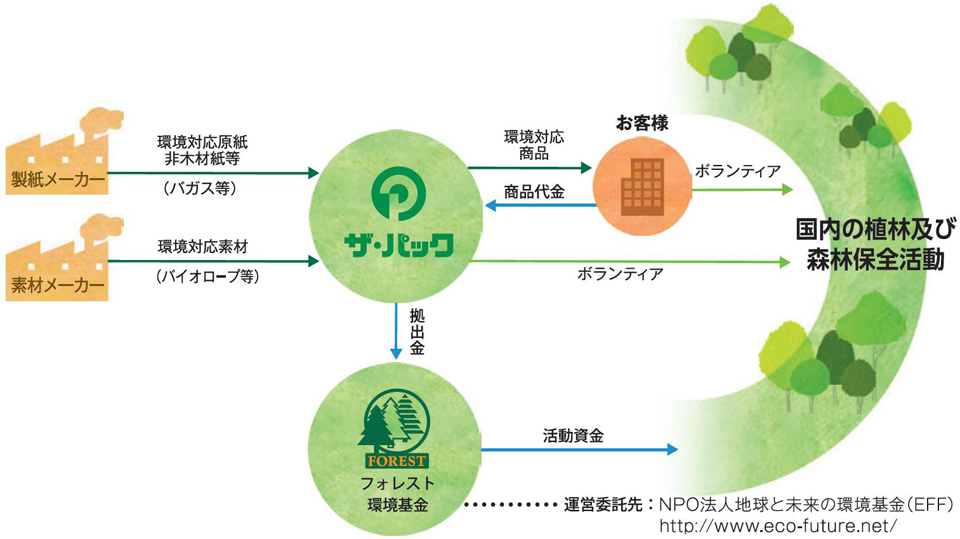

Starting with the commercialization of bagasse paper in 1993, our company has been developing environmentally friendly materials one after another. When we use these environmentally friendly materials in packaging, we contribute a portion of the sales proceeds to a fund, which is used to support forest conservation activities. This activity started in 2001 and is now 22 years old. To date, we have continued forest conservation activities at eight afforestation sites throughout Japan, in cooperation with local governments, local forest associations, and NPOs, which are experts in forest conservation.

Aihara:

How to minimize the damage caused by unavoidable natural disasters, etc., and the business of Japan Earthquake and the SDGs are inextricably linked. Next, could you give us an overview of JASSO?

Mr. Nishio:

JASSO was established in April 2004 through the consolidation of the Japan Scholarship Foundation, which provided scholarship loans and four international student-related organizations. The purpose of JASSO's establishment was to contribute to the development of creative people with an abundance of humanity who will lead society in the future, through the lending and payment of educational funds and other support for students' studies in order to contribute to equal educational opportunities.

Mr. Nishio

Japan Student Services Organization

Finance Manager

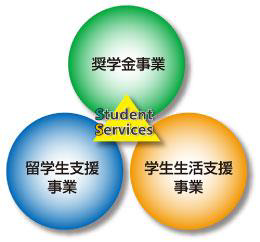

The first pillar of JASSO's business is a scholarship program to support the right to receive an education as stipulated in Article 26 of the Constitution of Japan and the equal educational opportunity set forth in Article 4 of the Basic Act on Education. The second pillar of JASSO's business is an international student support program that supports international students, both in terms of sending Japanese students overseas to study and receiving foreign students to study in Japan. The third pillar of JASSO's business is a student life support program that supports career education, employment, and students with disabilities. The scholarship program can be broadly divided into two types. In principle, there are benefit scholarships that do not have to be repaid and loan scholarships that must be repaid. Furthermore, these loan scholarships are divided into Type 1 scholarships with no interest and Type 2 scholarships with interest.

All of the funds raised through the issuance of JASSO social bonds will be used to finance Type 2 scholarships that have interest. For reference, here are the results of the scholarship program. First of all, the benefit scholarship program was launched in 2017, but the support system was expanded in 2020. In four years, about 330,000 students have received scholarships, and the total amount of scholarships has been about \146 billion. On the other hand, the loan scholarship program has a 79-year history dating back to the Japan Scholarship Foundation. To date, about 14.13 million students have received scholarships, and the total amount of loan scholarships awarded has been about \22 trillion.

Aihara:

At Nomura, there are many employees who funded their own education with scholarships from JASSO and then went on to work with us, and I feel that the scholarship program is expanding.

Mr. Nishio:

Thank you. When we think about the business of the Japan Student Services Organization in relation to the SDGs, I think the easiest thing to imagine is contributing to the achievement of Goal No. 4, "Quality Education for All."

Aihara:

Please tell us about the characteristics and framework of JASSO social bonds, the purpose of issuing them as social bonds, and the history of JASSO social bonds.

Mr. Nishio:

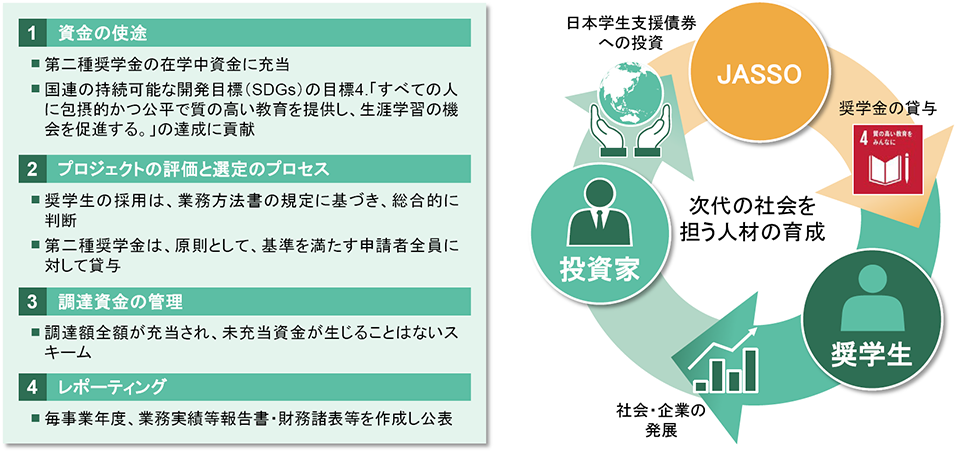

First, there are three characteristics of JASSO social bonds. The first is that there are only a limited number of cases of education-related social bonds in the domestic bond market. Second, as a rare two-year bond in the domestic bond market, JASSO social bonds are regularly issued four times a year in June, September, November, and February. Third, JASSO has obtained a second opinion on social bonds from Moody's ESG Solutions, an overseas ESG evaluation agency, and has obtained a second opinion for each bond issue number. In addition, JASSO has been rated AA+ by R&I (Rating and Investment Information Center) and AAA by JCR (Japan Credit Rating Agency). As the rating is the same as that of Japanese government bonds, JASSO believes that JASSO social bonds can be invested in with confidence.

Next, the JASSO social bond framework is based on the Social Bond Principles set forth by the International Capital Market Association (ICMA). The entire amount of funds invested by investors is used only for loans during the student period, making it easy for the public to understand JASSO's contribution to Goal 4 of the SDGs.

The first purpose of JASSO's issuance of social bonds is to raise the funds necessary to continue our operations, so it is important to expand the pool of investors and achieve stable funding from a medium- to long-term perspective. The second purpose is to make more people understand JASSO's efforts and contributions to social issues.

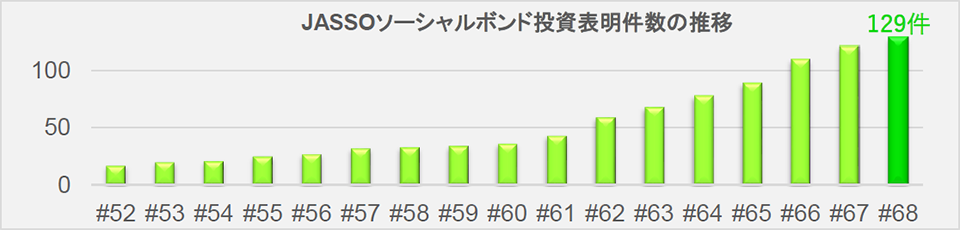

About four years ago, when JASSO started issuing social bonds, SDG bonds were still in their infancy, but we wanted this market to develop and expand in the future. By providing social bonds ourselves, we wanted to contribute as much as possible to the spread and development of SDG bonds in the domestic bond market. In addition, since JASSO was established as an independent administrative agency in 2004, JASSO has issued bonds up to the No. 67 issue in June.

Mr. Nishio:

As JASSO social bonds, JASSO has been issuing bonds since No. 52 in 2018, No. 52 and the maturities are two years, \30 billion per issue, and four regular issues per year. As for the issuance yields, JASSO social bonds have had a yield of 0% for the past several years, partly because the yields for JGBs have been negative due to the Bank of Japan's monetary policy. Despite this situation, we continue to receive investment announcements, and recently we have received interest from private sector companies. The Pack Corporation also made an investment declaration this past January.

Aihara:

I would like to ask Mr. Fujii. Could you tell us about the background behind your decision to invest in JASSO social bonds?

Mr. Fujii:

JASSO has been involved in the scholarship business for 79 years since its predecessor, the Japan Scholarship Foundation, and I have been familiar with the organization since I was a student. However, I first learned about JASSO social bonds when I was considering purchasing them.

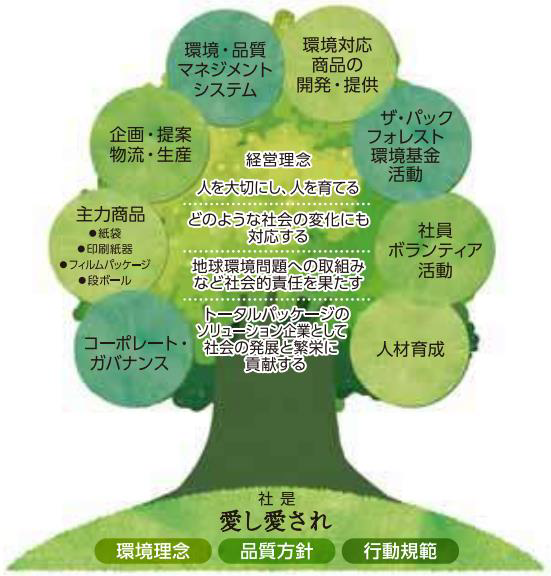

This year marks 70 years since The Pack Corporation was founded, and the company itself dates back to 1878. At that time, the company produced paulownia boxes under the name of Hakokosa. The Pack Corporation was established as a company in 1952 and has continued to this day. Shigenari Morita, the founding president of the company at the time of its establishment, was deeply moved by the employees who believed in him and followed him during the company's founding period, shortly after the end of World War II. He left behind the company motto, "Love and be loved," with the intention of valuing not only customers but also employees. The company's management philosophy also includes the phrase "Caring for and nurturing people."

One day, when we received information about JASSO social bonds from a securities company, we strongly felt that our company's motto and management philosophy are related to SDG Goal 4, "Providing Quality Education for All," so we decided to make an education-related investment. We also established a new internal rule called an ESG investment amount, which had not been established before. When looking at our business, it may seem that we are directly linked to environmental issues, but at our company, we have always had a strong interest in the SDGs not only for environmental issues but also for social issues in general. For this reason, we established internal rules from the perspective of promoting ESG investment only in those matters related to our company's core business and those related to our company motto and management philosophy, even though investment funds are limited. After establishing this investment amount, we invested in JASSO social bonds as our first investment.

Aihara:

Do you have any other initiatives with respect to social issues?

Mr. Fujii:

We recognize that we are still in the middle of deciding our path with respect to social issues. We are currently in the process of formulating a sustainable management policy. Regarding ESG initiatives, in addition to what I mentioned earlier, we have started investing in a fund that invests in renewable energy businesses. We recognize that this will lead to solving environmental and social issues. In the future, we would like to continue investing in things related to our company's management philosophy and core businesses.

Aihara:

From our vantagepoint, we have seen a lot of moves by companies to expand their investments in ESG. The number of investment announcements by companies is increasing in terms of investment announcements for SDGs bonds as mentioned earlier by JASSO. We expect that the number of companies that make ESG investments will increase in the future, so what advice would you give to corporations that are considering such an investment?

Mr. Fujii:

There are many ESG-related investment targets in the world, so I think it is better to clarify in advance the company's policy and philosophy about what kind of investments it wants to make. When we receive information from securities companies and other financial institutions, I think it would be better to clarify the purpose and philosophy with respect to investment and communicate them in advance so that they can introduce better investment options.

Aihara:

Next, I would like to ask JASSO. Please tell us your thoughts on the SDGs from the perspective of a bond issuer, your opinion on ESG investment, and what you think about ESG investment by companies.

Mr. Nishio:

I believe that ESG investment and the issuance of social bonds are a means to achieve the SDGs, so the most important thing is that they genuinely want to contribute to solving social issues and improving the environment, or that they sympathize with the business. From this point of view, for example, the purchase of JASSO social bonds is not simply a bond investment, but also contributes to the SDGs, or as part of efforts to address issues that are difficult to contribute to on their own.

As interest in the SDGs increases in society as a whole, I believe that JASSO social bonds have been able to contribute to the achievement of Goal 4, "Quality Education for All." When I hear from students today, I feel that their awareness of the SDGs is very high. In this context, I believe that companies’ efforts to address the SDGs will lead to those companies becoming more attractive, including from the viewpoint of recruiting personnel.

Aihara:

I imagine that The Pack Corporation participates in IR meetings with investors as an issuer. Do you tell investors that you, as an investor, have established an amount of money for ESG investment?

Mr. Fujii:

We hold IR meetings on an ongoing basis, and we tell investors that we have established such an ESG investment framework.

Mr. Ouchi (left)

General Manager

Ms. Okada (right)

Public Relations

Mr. Ouchi:

Many operating companies like ours promote ESG initiatives in various ways. However, for initiatives that are difficult to tackle on one’s own, such as the forest conservation activities I mentioned earlier, we sometimes collaborate with outside organizations, such as NPOs. What we thought this time was that it is difficult to directly invest in the field of education, so we thought it would be better to invest in an organization that specializes in education.

At our company, we have been participating in hands-on manufacturing workshops for about 20 years. Higashi-Osaka City, where our Osaka Plant is located, has a thriving local industry and many small- and medium-sized manufacturers. Higashi-Osaka City has commissioned an NPO to hold hands-on workshops to provide opportunities for elementary school students in the city to experience the joy and importance of manufacturing. We agree with the city's idea and conduct on-site classes at several elementary schools every year. We would like to create other opportunities for learning like this. We will actively work on what we can do by ourselves, while supporting what we cannot do by ourselves through outsourcing and investment.

The "Monozukuri hands-on workshop"

Mr. Nishio:

For JASSO, it is very meaningful to deepen our relationship with investors through meetings like this one. Through today's meeting, I have become even more confident that we need to showcase JASSO's efforts. I hope this will serve as a reference in the future, but from the perspective of investors, could you give us some advice on how to promote JASSO's social bonds?

Mr. Fujii:

Given that ESG bonds are on the rise, investors also need to study the market thoroughly. Investors often get information from financial institutions, so it is important to collect information after clarifying the purpose of investment.

Aihara:

The Pack Corporation is listed on the Prime Market of the Tokyo Stock Exchange. Do you have to consider ESG because you are listed on the Prime Market, or have you become more aware of ESG due to the recent developments with disclosure, or are your ESG efforts simply the result of the build-up of past efforts?

Mr. Ouchi:

Packaging materials are originally intended to wrap things, and customers want the things that are wrapped, and thus packaging material inevitably ends up being thrown away. For this reason, the idea of "If it's going to be discarded anyway, let's make something good for the environment," has long been rooted in our company. As a manufacturer of packaging materials, we will continue to do our best to consider what we can do for society and the environment.

Aihara:

ESG is very much an extension of the business we have been engaged in for a long time, and now I understand that the terms ESG and SDGs apply to what we have historically been doing.

Engagement conversation

Mr. Fujii:

Recently, there has been a lot of talk about "purpose-based management" and a company’s "raison d'etre," but we have not defined it from that perspective. At the Pack Corporation, we are in the process of discussing purpose and other issues as we formulate our sustainable management policy. If we were to be asked, "What kind of company are you?" one example of our answer would be that we enrich society and make people smile through our packaging.

As for our listing on the Prime Market that you mentioned earlier, we made a decision based on internal discussions. As an analogy, choosing to list on the Prime Market means going down a thorny path. This is because there are costs in terms of having a sustainable management policy, TCFD-related work, and disclosure in English. However, we felt that as long as we meet the criteria for listing on the Prime Market, we should be a company that satisfies those requirements. Before listing on the Prime Market, we had been working on ESG and the SDGs, but we are working on how to systematize those activities.

Mr. Shimomura:

From the perspective of environmental considerations, the packaging materials we make, such as paper bags and boxes, are all disposed of, so I think it is possible to argue that we should get rid of them. However, we want to continue to value packaging that wraps things up and makes them look elegant, and we think that packaging is a wonderful culture. So, we are making company-wide efforts to make this culture sustainable.

Aihara:

Thank you. It was a very productive meeting. It has not been commonplace for issuers and investors to meet face to face to discuss the specifics of bonds. Also, ESG bonds have a relatively short history, and I recognize that ESG bonds are positioned as a very new product. However, about 30% of bonds currently issued are already ESG bonds. An increasing number of bonds in the market are not simply aimed at raising funds, but also for solving social issues and improving the environment. From an investor's perspective, ESG bonds not only provide a return on investment funds based on the scheduled maturity, but social bonds help solve social issues and green bonds help improve the environment.

I mentioned earlier that about 30% of bonds issued are ESG bonds, and this ratio is on an upward trend. As the market itself is expanding, Nomura, as a securities firm, will continue to play the role of connecting issuers and investors, and we will also further expand our efforts to achieve the SDGs.