Aiming to Realize a Society in which No One is Left Behind: Considering Support for the Young Generation through Social Bonds

Japan Earthquake Reinsurance Co., Ltd. (hereinafter, "Japan Earthquake"), the only reinsurance company for household earthquake insurance in Japan and which actively invests in SDG bonds to manage and administer insurance premiums, and Japan Student Services Organization (hereinafter, "JASSO"), which issues social bonds on a regular basis, held an engagement meeting targeting the further development of the SDG bond market.

Participants

| Japan Earthquake Reinsurance Co., Ltd. | Japan Student Services Organization | Nomura Securities Co., Ltd. |

|---|---|---|

|

|

|

Aihara:

Today, as part of our engagement meeting, we would like to hear from an investor, Japan Earthquake, and an issuer, JASSO, about their business activities and SDG initiatives. First, can you tell us about the business of Japan Earthquake?

Japan Earthquake Reinsurance Mr. Tashiro

Mr. Tashiro:

Since the launch of the earthquake insurance system in 1966, Japan Earthquake has been working to realize our business philosophy of "Through the sound management of the household earthquake insurance system, we aim to contribute to the maintenance and development of an affluent and safe social system and to be a company widely trusted by society," as a reinsurance company that exclusively underwrites domestic household earthquake insurance. In response to earthquakes such as the Great Hanshin-Awaji Earthquake in 1995, the Great East Japan Earthquake in 2011, and the Kumamoto Earthquake in 2016, as well as the fire and tsunami disasters that accompanied them, we have been striving to make swift and reliable reinsurance payments, which is the greatest mission of Japan Earthquake. Since earthquake insurance plays an important role in supporting the lives of people affected by these disasters, a reinsurance system has been developed between the government, non-life insurance companies, and Japan Earthquake, and the public and private sectors work together to ensure swift and reliable delivery of earthquake insurance benefits.

Aihara:

Could you briefly explain how earthquake insurance works?

Japan Earthquake Reinsurance Ms. Miyazaki

Ms. Miyazaki:

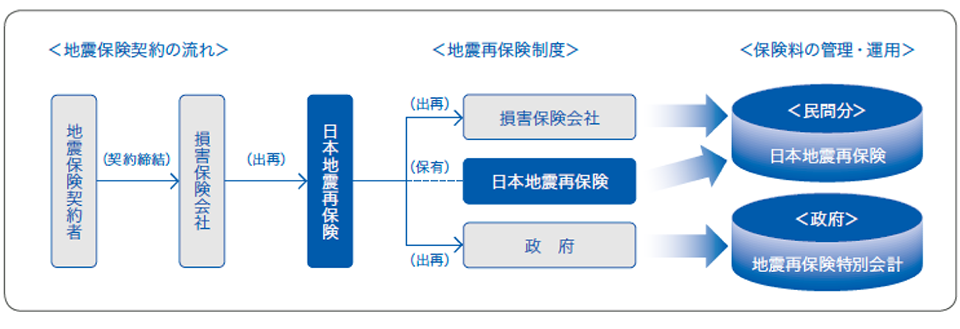

The earthquake insurance premiums received from earthquake insurance policyholders by the original non-life insurance company (a non-life insurance company that directly underwrites insurance from general policyholders) are ceded in bulk to Japan Earthquake. Japan Earthquake then cedes the premiums to the government and non-life insurers. During normal times, we manage and invest the earthquake insurance premiums received from policyholders along with the government. In the event of an emergency, Japan Earthquake stands between the government and the original non-life insurance company and takes sole responsibility for managing the payments of insurance claims. Through the original non-life insurance company, the insurance claims are delivered quickly and reliably to policyholders affected by the disaster. Even when a major disaster occurs due to an earthquake and a huge amount of money needs to be paid, the system is highly reliable with the support of the government.

Aihara:

I think the number of enrollees tends to increase after an earthquake. Is there a correlation between the number of enrollees and insurance premiums?

Ms. Miyazaki:

Immediately after an earthquake occurs, the number of people buying earthquake insurance tends to increase. However, in the case of earthquake insurance, premiums do not fall as the number of enrollees increases. The Non-Life Insurance Rating Agency calculates premiums fairly based on various earthquake models and conditions, so premiums for the year following a major earthquake, for example, will not increase. As an aside, in addition to earthquakes that occur in Japan, there are also cases in which payments are made if Japan is damaged by tsunamis caused by earthquakes that occurred overseas.

Aihara:

I understand that earthquake insurance is an excellent system for ensuring fairness and stability. I feel that Japan Earthquake and the SDGs are highly related to one another because the SDGs include the philosophy of leaving no one behind. What do you think?

Mr. Tashiro:

Yes. You may have heard of the Nankai Trough Earthquake and the Tokyo Metropolitan Earthquake as major earthquakes that are expected to occur in the near future. However, disasters are not limited to large earthquakes such as these. There are a variety of disasters, such as weather disasters that intensify and recur frequently, pandemics, and cyberattacks. Moreover, simultaneous occurrence of disasters must also be assumed. As a reinsurance company specializing in earthquake insurance, therefore, Japan Earthquake recognizes that it is important to promote the development of systems that enable prompt reinsurance payments in the event of an emergency. At the same time, we recognize that it is also important to promote the SDGs, such as efforts to resolve social issues, including strengthening disaster prevention capabilities to minimize damage to society in the event of a disaster, and improving resilience to overcome disasters and recover quickly. For example, at first glance, it may seem that global warming has nothing to do with earthquake insurance, but as global warming progresses, sea levels will rise, and the damage caused by tsunamis accompanying large earthquakes will become more widespread. In addition, even if the SDGs are not aimed at earthquake countermeasures, the development of urban disaster prevention and building resilience will ultimately contribute to reducing earthquake disasters. By promoting the SDGs in this way, there will be significant benefits for earthquake insurance, such as lower insurance premiums in the future, which will lead to the spread of earthquake insurance and create a virtuous cycle in which society as a whole will enhance its resilience to earthquakes. This is just one example, but Japan Earthquake will promote SDGs and expand ESG investment.

Aihara:

How to minimize the damage caused by unavoidable natural disasters, etc., and the business of Japan Earthquake and the SDGs are inextricably linked. Next, could you give us an overview of JASSO?

Mr. Tonegawa:

JASSO was established in April 2004 through the consolidation of the Japan Scholarship Foundation, which provided scholarship loans and four international student-related organizations. The purpose of JASSO's establishment was to contribute to the development of creative people with an abundance of humanity who will lead society in the future, through the lending and payment of educational funds and other support for students' studies in order to contribute to equal educational opportunities.

The first pillar of JASSO's business is a scholarship program to support the right to receive an education as stipulated in Article 26 of the Constitution of Japan and the equal educational opportunity set forth in Article 4 of the Basic Act on Education. The second pillar of JASSO's business is an international student support program that supports international students, both in terms of sending Japanese students overseas to study and receiving foreign students to study in Japan. The third pillar of JASSO's business is a student life support program that supports career education, employment, and students with disabilities. The scholarship program can be broadly divided into two types. In principle, there are benefit scholarships that do not have to be repaid and loan scholarships that must be repaid. Furthermore, these loan scholarships are divided into Type 1 scholarships with no interest and Type 2 scholarships with interest.

All of the funds raised through the issuance of JASSO social bonds will be used to finance Type 2 scholarships that have interest. The benefit scholarship program, which in principle does not require repayment, was launched in 2017 and has provided a cumulative total of approximately ¥290 billion to approximately 660,000 students in the five years since the program began. The scholarship program was launched by the former Japan Scholarship Foundation in 1943 and has provided a cumulative total of approximately ¥23 trillion to approximately 14.49 million students in the 79 years since the program began, with approximately one out of every in 3.1 students using the program.

Aihara:

The scholarship system has a long history of approximately 80 years, and when I heard that approximately one in 3.1 students use the loan scholarship system, I realized that the scholarship system is an essential part of the Japanese educational system. JASSO has been issuing social bonds since 2018. Could you tell us about the characteristics of the system, its purpose, and its framework? Also, could you tell us about the history of issuing social bonds?

Japan Student Services Organization

Mr. Tonegawa

Mr. Tonegawa:

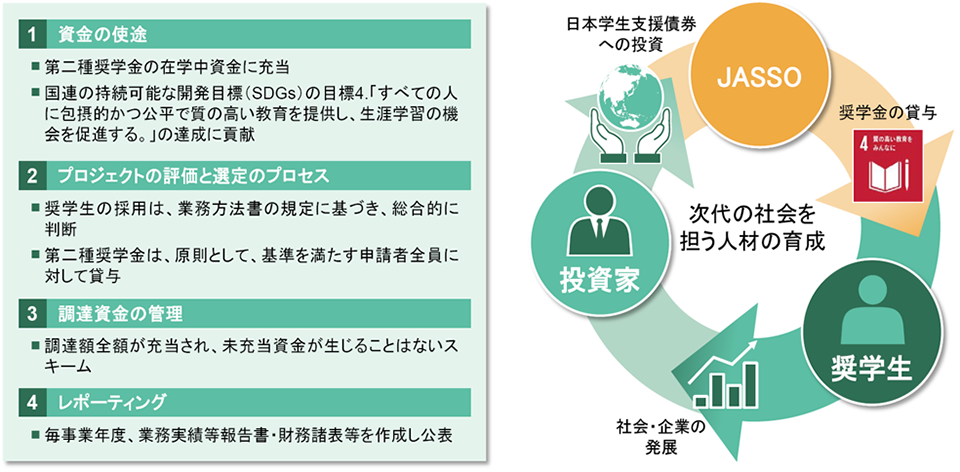

There are three main characteristics of JASSO social bonds. First, while there are few cases of education-related social bond issues in the domestic bond market, JASSO social bonds contribute to the achievement of Goal 4 of the SDGs, which targets quality education for all. Second, JASSO social bonds are regularly issued four times a year in June, September, November, and February, as two-year bonds, which are rare in the domestic bond market. Third, JASSO social bonds have been rated AA+ by R&I (Rating and Investment Information Center) and AAA by JCR (Japan Credit Rating Agency). As they are rated at the same level as Japanese government bonds, JASSO social bonds are easy to invest in from a security perspective.

The JASSO social finance framework (bonds and loans) is formulated based on the social bond principles set forth by the International Capital Market Association (ICMA). The entire amount of funds invested by investors is used only for loans during the student period, making it easy for the public to understand its contribution to Goal 4 of the SDGs. The first purpose of JASSO's issuance of social bonds is to expand the pool of investors and achieve stable funding from a medium- to long-term perspective. The second purpose is to have as many people as possible understand JASSO's efforts and contributions to social issues. Third, when JASSO started issuing social bonds in 2018, SDG bonds were still in their infancy, but we wanted them to further develop and expand in the future. By providing social bonds ourselves, we wanted to contribute to the spread and development of SDG bonds in the domestic bond market.

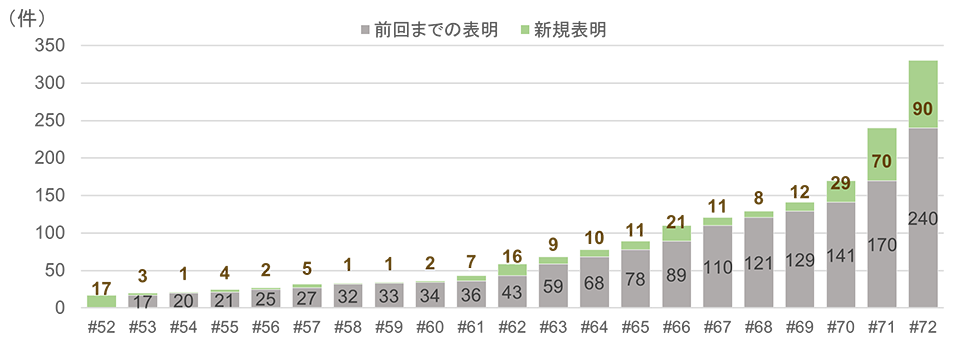

Since JASSO was established as an independent administrative agency in 2004, JASSO has issued bonds up to Bonds No. 72, which were issued in September. As for JASSO social bonds, JASSO has issued bonds since No. 52 in 2018, with a maturity of two years and \30 billion per issue, and we continue to issue bonds four times a year. We receive investment declarations from organizations who support our business that contributes to society, such as Japan Earthquake. Recently, as awareness of ESG investment spreads, the number of investment declarations from local governments, educational institutions, and companies has increased. The number of investment declarations in the most recent period has increased steadily to 29 for Bonds No. 70, 70 for Bonds No. 71, and 90 for Bonds No. 72, bringing the total to 330. Issuance yields, which have been affected by domestic interest rates, have been at a real yield of 0%. However, interest rates have been on an upward trend since last summer, and an increasing number of investors are showing interest in the yields as well.

Aihara:

I think the reason why the number of new investors has increased with each issue is that the improvement of the issuance conditions due to the rise in market interest rates has a positive effect, but I think the biggest factor is that JASSO has attracted many investors' supports for its unique business of supporting young people who pursue higher education. Could you tell us about the background behind the decision of Japan Earthquake to invest in JASSO’s social bonds?

Mr. Tashiro:

Taking into account our public nature as an earthquake reinsurance company, Japan Earthquake is engaged in ESG investments with the aim of providing funds to companies and businesses that are better in terms of the environment and society, aiming to both earn investment income and solve social issues. When selecting investment targets, we make a comprehensive decision by taking into account not only financial information but also the company's ESG initiatives, such as how it addresses environmental and social issues. In fiscal 2022, Japan Earthquake invested in a total of 21 SDG bonds. In fiscal 2022, the amount of investment in securities decreased due to an increase in insurance claims paid, but since fiscal 2020, we have continued to invest in SDG bonds at a level exceeding 10% of our investment amount. This includes social bonds issued by JASSO.

At Japan Earthquake, we have invested the large amount of policy reserves we have accumulated as an insurance company, mainly through bond investments. We have also been purchasing "Japan Student Support Bonds" issued by JASSO. We have invested with confidence in this project that has supported many students who will lead society in the future for many years. We have been purchasing social bonds since 2018. In addition, we are taking various opportunities, including investor relations (IR), to encourage issuers to advance concrete initiatives to combat climate change and take earthquake countermeasures through constructive dialogue. Through engagement, we hope to deepen issuers' understanding of the SDGs and encourage their activities, as well as gain their understanding with regards to our efforts as a company. This is because earthquake preparedness is designed to directly protect the executives and employees of issuing companies, their supply chains, and the people with whom they have relationships. We believe it is important for issuers to recognize that if these efforts are insufficient, they will not only be unable to advance their SDG efforts, but that it will also jeopardize their business continuity itself, and we urge them to take action.

Aihara:

Both JASSO and Japan Earthquake play extremely public roles and essential roles in society, so I think this engagement meeting is very meaningful. Recently, due to environmental change on a global scale, we often hear the phrase "for the first time in recorded history." Could you please explain again how to prepare for earthquake risks?

Engagement conversation

Ms. Miyazaki:

The Japanese government has announced that there is a 70% to 80% chance of a major Nankai Trough earthquake or an earthquake directly beneath the Tokyo metropolitan area occurring within the next 30 years. This indicates that students have a very high probability of such an earthquake occurring during their lives. The Great Hanshin-Awaji Earthquake in 1995 and the Great East Japan Earthquake in 2011 claimed many lives, even among young students. More recently, the 2016 Kumamoto Earthquake also claimed the lives of students from which many great things were expected. We should be well aware that earthquakes can cause great damage, but are we fully prepared for such earthquakes? It is not limited to students, but there are many people who are aware of the need to prepare, but do not know what to do, and are thus not fully prepared.

Some of the characteristics of earthquakes are that: (1) it is difficult to statistically grasp the frequency and magnitude of earthquakes; and (2) the damage may sometimes be unusually large, making it difficult to treat them as insurance. I have briefly mentioned the mechanism of earthquake insurance. In the wake of the Niigata Earthquake in 1964, it was difficult to manage earthquake insurance solely by private non-life insurance companies. Therefore, the government became involved through reinsurance. In other words, it became possible to provide the public with stable insurance at low premiums by jointly managing it among the public and private sectors. Some people may feel that earthquake insurance premiums are high, but since earthquake insurance is an extremely public type of insurance that aims to stabilize people's lives in the event of a disaster, insurance premiums do not include profits for insurance companies and are set at a level that makes it easier for consumers to purchase insurance. In addition, the balance after deducting insurance benefits and expenses from insurance premiums is set aside in reserves to prepare for future insurance benefit payments. We believe that promoting enrollment in earthquake insurance with the public benefit it provides society is in line with the objectives of the SDGs.

With regard to earthquake countermeasures, (1) the first challenge of protecting lives is the most important thing. For this, it is necessary to promote disaster prevention and mitigation efforts, such as making buildings earthquake-resistant and fireproof, and installing tsunami disaster prevention facilities and seawalls. It is also necessary to make steady efforts to raise awareness, such as for "evacuating quickly and without hesitation." As for the second challenge, it is important to overcome the financial difficulties that occur after an earthquake. If the house you used to live in is destroyed or gets knocked off its foundation, major repairs will be required, and you may find yourself in a difficult situation where you lose your house and only have a home loan left. In other words, you may suddenly face unexpected financial difficulties that affect your life. In order to rebuild your life after an earthquake, you will need a large amount of money, but public assistance alone is not enough at all. Therefore, earthquake insurance is one way to prepare yourself.

In response to the second challenge, Japan Earthquake has played an important role in supporting the lives of those affected by disasters through the administration of earthquake insurance and has made every effort to establish a system to ensure that insurance benefits are paid when an earthquake occurs. However, the spread of earthquake insurance as a preparedness measure is still not sufficient (the most recent coverage rate for households was 34.6%). In order to support as many people as possible with funds to rebuild their lives after an earthquake, we are promoting efforts to make more people enroll in earthquake insurance, including by establishing a YouTube channel.*

Currently, we are bolstering our efforts to address the first challenge. In announcing its investment in the Japan Student Support Bonds No. 71 Social Bonds, Japan Earthquake created a leaflet to encourage students, encouraging them with the phrase "Let's prepare for an earthquake together!" JASSO not only posted this leaflet on its website, but also introduced it at a seminar for university officials. We are thinking of collaborating with other institutions in the future, and the creation of the leaflet and this engagement will be a starting point for that.

Japan Earthquake Reinsurance YouTube Official Channel

Aihara:

Could you tell us about JASSO’s special efforts for disasters such as earthquakes?

Mr. Miyata:

Normally, scholarships are accepted by students at a determined time. However, for students whose finances have suddenly changed due to disasters, whether earthquakes or other disasters, we flexibly allow them to accept benefit scholarships if their financial situation has suddenly changed, while for students who have received loan scholarships, we accept scholarships for emergency purposes. Also, for those who are repaying their loan scholarships, we offer grace periods for certain periods of time or reduce the repayment amount if they apply for these accommodations. In addition, for students who have had more than half of the house they live in collapse, or if water has intruded under the floor, we provide disaster relief funds that do not need to be repaid in order for them to return to living a normal life as soon as possible and continue their studies.

Mr. Tonegawa:

As mentioned by Japan Earthquake, the leaflet titled "From Japan Earthquake Reinsurance: Let's all prepare for earthquakes!" is an investment statement, but it indirectly contributes to educational activities about earthquakes targeting students by introducing it on the JASSO website, in seminars where university officials gather, and in IR materials for social bonds.

Aihara:

Your support is quite flexible. On a different topic, could you please tell us about your personal experience, such as what inspired you to join the company or the organization, and what makes your work rewarding?

Japan Student Services Organization, Manager,

Mr. Miyata

Mr. Miyata:

My parents are teachers, and I wanted to work in a job that would support students. I thought about becoming a teacher, but I was attracted to the fact that I could provide the necessary support to many students who truly needed it. Currently, I work in a department that examines various aspects of the scholarship system, and I find it extremely rewarding to see the numbers that show an increase in the percentage of students who go on to pursue higher education, and to hear that JASSO scholarships have contributed to the lives of students in a positive way.

Mr. Tonegawa:

I loved education so much that I wrote about it in my graduation thesis at university. I also used scholarships to fund my education, so I knew about JASSO. I joined JASSO because I was attracted to its ability to support so many students. After actually starting to work in the fund management section, I felt that I was doing something for so many students every day, albeit indirectly, and I find my work to be very fulfilling.

Ms. Miyazaki:

There are about 30 employees at Japan Earthquake, many of whom joined the company mid-career. When I was a student, I also wanted to pursue education, and I used a scholarship from JASSO to attend university. After graduation, I worked for a general business company, but I wanted to continue working in a way that would help people in times of need. I joined the company because I sympathized with the public nature of the JASSO insurance program, which is operated jointly by the public and private sectors. I find it extremely rewarding to be able to contribute to the stable lives of the people of Japan as a part of the cornerstone of the system of collaboration and cooperation with government ministries, agencies and insurance companies.

Mr. Tashiro:

In my previous job, I was involved in securities management. My biggest motivation for joining JASSO was the high level of public service the organization provides. After the earthquakes off the coast of Fukushima Prefecture in February 2021 and March 2022, we paid more than \200 billion yen in reinsurance claims, and I strongly feel that our asset management operations are directly linked to the payment of reinsurance claims in the event of an emergency. Since asset management is conducted in preparation for an emergency, it is necessary to achieve profitability while securing liquidity and safety. Furthermore, apart from making our own assumptions about the future market outlook, we also ask market participants in the form of questionnaires about the market situation at the time of a major earthquake and how it will develop thereafter. I find this to be both challenging and interesting.

Aihara:

Could you tell us if there are any unique cultural qualities or action guidelines that reflect ESG concepts and policies in each of the businesses you are all involved in?

Mr. Tashiro:

At Japan Earthquake, at least once a year we conduct a drill where employees walk home from work. It is difficult for me because the office is a little far from my home, but I feel that it is a good way to prepare for an emergency by checking how far I can walk depending on the weather and my physical condition, and in normal times I make sure to check the wide-area evacuation spots and convenience stores along the way.

Ms. Miyazaki:

Since Japan Earthquake is a company that specializes in earthquakes, we conduct joint training in the form of company-wide exercises assuming a major earthquake. We also regularly check the preparedness of our homes using checklists published by the Tokyo Metropolitan Government. In addition, as part of our efforts to promote the spread of earthquake insurance and to reduce disaster risk, we have also collaborated with the General Insurance Association of Japan to provide free lectures on the earthquake insurance system for university students studying law or economics.

Mr. Tonegawa:

With regard to disaster prevention, JASSO is in the process of expanding and rebuilding our offices, including strengthening their ability to withstand earthquakes. In addition, JASSO is making preparations including holding regular evacuation drills and appointing critical personnel in the event of an emergency. We have established a system under which each department can come to work even in the event of an emergency, so that it will not interfere with work such as scholarship payments even in the event of a disaster.

Mr. Miyata:

As part of JASSO’s unique philosophy and policies, we refer to the repayment of loan scholarships as "returning funds." We use this term because we believe that the funds returned will be used as a resource for the next student's loan scholarship.

Aihara:

Lastly, would you like to make a comment on this engagement conversation for those reading it as well as students?

Mr. Tonegawa:

JASSO will continue to consider new scholarship programs and disseminate information about such programs for students who truly need scholarships. I hope that students will find this information and make the most of it. I also hope that everyone will learn about JASSO’s philosophy and business activities and consider JASSO as a possible place to work in the future.

Ms. Miyazaki:

I want young digital natives to be exposed to a variety of systems and information. What drives the world is the power of young people who have a new sensitivity to information. Without a change in the mindset of the young people who will lead Japanese society in the future, there will be no change for society to improve. The same goes for understanding the importance of disaster prevention and mitigation and the need for earthquake insurance to prevent economic hardship. I want them to make their own decisions and take proactive measures to prepare for disasters. I also want students who will enter the real world to fully consider earthquake insurance when they purchase a house in the future.

Aihara:

Today was a very meaningful engagement meeting. In the past, it was unusual for issuers and investors to meet face to face and have an opportunity to discuss each other's business and social significance. In recent years, the share of ESG bonds in the bond market has been increasing rapidly with increasing awareness of ESG issues. From an investor's point of view, in addition to the marketability of bonds as bonds that provide yields based on scheduled redemptions, there is an additional incentive to invest in bonds, such as social bonds, which help solve social issues, and green bonds, which help improve the environment. Currently, ESG bonds account for about 40% of the bond market, but this share is on the rise. Nomura will work to further promote ESG bonds, which connect issuers and investors and contribute to the improvement of environmental and social issues.