Special Feature | Promoting Circulation of Risk Capital

In order to achieve our strategy in “expanding our business from public into private”,we aim to expand our business portfolio in terms of products and services.In addition to deepening Nomura Group’s existing strengths in public products and services such as listed stocks and investment trusts, we will also strengthen alternative investmentcapabilities including the private area such as private equity, private debt, and infrastructure.

Surrounding Environment

Needs of Investors

- Investors face investment selection difficulties under a persistent low interest rate environment

- Growing demand for new investment products such as alternative assets alongside traditional assets

Asset Management Business Environment

- Continuining trend of declining management fees

- Persistent low interest rate and diverse investor needs require expansion of alternative investment products.

Expand Private Products and Services

Investment Management Division

- Pursue competitive performance while ensuring the independence, diversity and mobility of each investment management product

- Strategies for the whole division are centralized in the planning department directly under the division, aiming to further expand the product portfolio and client base, and to improve the efficiency of business processes for the entire division by promoting standadization and digitization.

- Elevate investment management business and deliver services and solutions to meet increasingly diverse client needs

Private Equity Investment

Nomura Capital Partners provides equity and other risk capital to solve clients’ diverse and complex challenges, such as business restructuring, revitalization, succession and management buyouts.

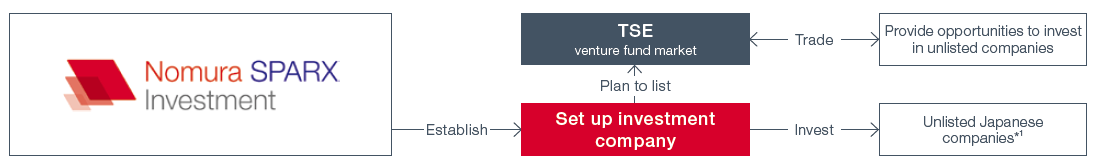

Listed Investment Company to Invest in Unlisted Companies

Nomura Group and SPARX Group jointly establish an investment company to invest in unlisted companies. The company will be listed on the TSE Venture Fund Market to provide investors opportunities to invest in unlisted companies.

1 The investment company invests in unlisted companies and can continue to hold shares for a period of time after the investee companies are listed.

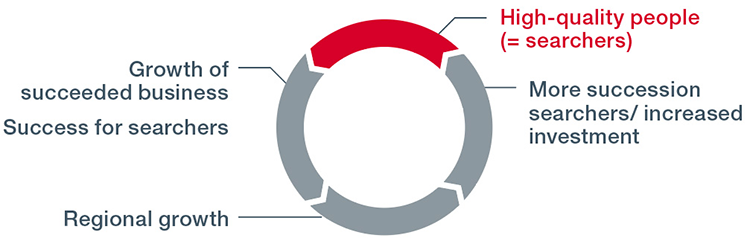

Fund of Search Funds

Nomura Group and JaSFA*2 will work together to set up fund of search funds that link aspiring managers with unlisted SMEs facing business succession challenges. We will contribute to optimize talent, enhancing enterprise value, and regional revitalization through the fund.

- Promote HR mobility to SMEs

- Contribute to revitalizing SMEs and regional development

2 JaSFA: Japan Search Fund Accelerator was established in May 2018 as Japan’s first search fund accelerator, as it provides investment and support towards search funds, marketing, and consulting services.

Private Debt Investment

Nomura Mezzanine Partners provides middle risk/middle return investment products. In addition to our unique expertise and network, we will utilize the Nomura Group platform to provide mezzanine financing, tailored to the Japanese market to meet the asset management requirements of institutional investors.

Aircraft Lease

Nomura Babcock & Brown provides high quality business investment opportunities by structuring international lease transactions for large-scale properties such as aircraft.

Other Alternative Investments

Nomura Asset Management will also work with external managers to provide a wide range of alternative products, including private equity, infrastructure and real estate investments, to a wide range of investors.

Wholesale

- Financing and structuring by leveraging broad network and insight

Infrastructure Finance

We have a business model which invests towards infrastructure and renewable energy-related financings and also for distribution to institutional investors.In addition to projects with high social demand (toll roads, wind power generation facilities, etc.), we are expanding new businesses such as commercial real estate and trade finance.

Structured Lending

We aim to expand our structured products to meet clients’ asset securitization needs and provide new investment opportunities for clients. We are strengthening our functions globally, such as mortgage-backed lending in the Americas, ABS financing in Europe, and Asian structured lending.

Advisory Business

We will strengthen our ability to provide highly customized solutions to clients’ business growth and capital policy strategy. In collaboration with Nomura Greentech, which we acquired in April 2020, we will contribute to the realization of a sustainable society by providing solutions in sustainable technology sectors.

Further Expansion in Private Area

Utilizing Nomura Group’s Comprehensive Capabilities

The newly established Investment Management Division will share expertise and knowledge, as well as access to Nomura Group’s client base. Through these synergies, we aim to provide high value-added services.

Inorganic Strategy

We will also incorporate an inorganic strategy to launch new businesses and expand our products and client base. Taking into consideration market size, growth potential, the competitive environment, and our comparative advantages, we will consider various options including outsourcing, developing alliances, and establishing subsidiaries through majority investment.