Promoting Sustainability

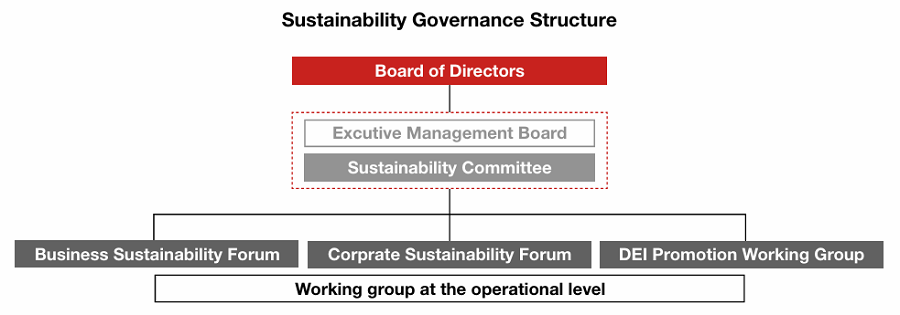

Our Sustainability Committee is a management-level decision-making entity that plays an integral role in Nomura Group's sustainable growth strategy and our aim to contribute to resolution of social issues.

Nomura implements sustainability initiatives in collaboration with Group offices and companies in Japan, Asia ex-Japan, EMEA, and the Americas. We conduct appropriate disclosure of our various initiatives through the Nomura Report and our website with the aim of raising our Group's corporate value.

Framework

Sustainability Committee

Nomura has established the Sustainability Committee, chaired by the Group CEO, and comprising other executives designated by the Group CEO that includes the Executive Management Board members, to deliberate and make decisions on strategies to achieve sustainability objectives. The Chief Sustainability Officer leads discussions in the Sustainability Committee to consolidate the company's sustainability activity and accelerate the formulation and promotion of strategies. The Committee also examines the operations of specific businesses that contribute to Sustainable Development Goals (SDGs) set by the United Nations. The Board of Directors offers advice on sustainability related reports prepared by executive officers.

In order to ensure opportunities for more flexible and substantive discussions on sustainability, the Sustainability Council, which was established and operated as a forum for discussion by executives from across departments and regions, was divided into the Sustainability Business Forum, which deals with topics more closely related to business activities, and the Sustainability Corporate Forum, which deals with information disclosure and policy formulation. Each forum will coordinate with the Sustainability Committee as appropriate to promote flexible approaches to sustainability.

Sustainability Committee Members

| Chairperson | Kentaro Okuda | President, Group CEO |

| Vice Chairperson | Yutaka Nakajima | Deputy President |

| Members | ||

| Toshiyasu Iiyama | Deputy President, Chief of Staff and Head of China Committee | |

| Takumi Kitamura | Executive Officer, Chief Financial Officer (CFO) and Chief Transformation Officer (CTO) | |

| Sotaro Kato | Executive Officer, Chief Risk Officer (CRO) (based in New York) | Shinichi Mizuno | SMD, Joint Chief Compliance Officer (CCO) | Takako Mori | SMD, General Counsel and Joint Chief Compliance Officer (CCO) |

| Hiroyuki Moriuchi | SMD, Group Finance | |

| Masahiro Goto | SMD, Head of Executive Management Headquarters | |

| Naotaka Minami | SMD, Chief Strategy Officer (CSO) | |

| Christopher Willcox | Executive Officer, Head of Wholesale and Chairman of Investment Management (based in New York) | |

| Go Sugiyama | SMD, Head of Wealth Management | |

| Yoshihiro Namura | SMD, Head of Investment Management | |

| Shinichi Okada | SMD, Head of Banking | |

| Chie Toriumi | SMD, Group Sustainability and Financial Education, Chief Sustainability Officer (CSuO) | |

| Yosuke Inaida | Executive Officer, Head of Content Company and Global Regulatory Affairs | |

| Hajime Ikeda | SMD, Head of Digital Company and Wealth Management Division Marketing | |

| Satoshi Kawamura | SMD, CEO and President of Nomura Holding America Inc. (based in New York) | |

| John Tierney | SMD, CEO of Nomura Europe Holdings plc and CEO of Nomura International plc (based in London) | |

| Nags Sankaranarayanan | SMD, Representative Director and CEO of Nomura Asia Pacific Holdings Co., Ltd. (based in Singapore and Hong Kong) | |

| Auditor | Shoji Ogawa | Director, Member of the Audit Committee and Board Risk Committee |

Management Status of the Committee

| Number of Meetings | 14 (from April 1, 2024 to March 31, 2025) |

|---|---|

| Agenda |

|

| Outline of Discussions |

|

Chief Sustainability Officer

In April 2023, a Chief Sustainability Officer was appointed to further accelerate our sustainability initiatives. The Chief Sustainability Officer is responsible for implementing sustainability related strategies including gathering information on sustainability locally and globally, managing the progress of sustainability-related measures, and developing sustainability-related policies and frameworks. Specifically, the Chief Sustainability Officer leads discussions at the Sustainability Committee meetings and the Sustainability Forums and also acts as the flagship for promoting sustainability by communicating our initiatives to the public. In addition, the Group Sustainability COO office which was newly established to consolidate planning functions and human resources related to sustainability, has been promoting sustainability-related business incubation and enhancing the disclosure of sustainability initiatives as non-financial information under the leadership of the Chief Sustainability Officer in collaboration with global sustainability team across London and Powai.

Capability Building through Sustainability Training

Nomura is working to raise awareness of sustainability among its executive officers and employees by providing learning opportunities through training, study sessions, and online programs to develop talent that meets the diverse needs of clients.

In Japan, sustainability training is held once a year for all executive officers and employees. Also in FY2023, we held in-house workshops linked to a financial education program for employees (Nomura Financial Wellness Program).

We also provide opportunities to learn about sustainability during training for new employees and training by title, such as newly appointed managers and executive officers. Since November 2020, the Nomura Sustainability Research Center has held in-house workshops with specialists and academic experts. The Wholesale Division provides training on sustainable finance for executive officers and employees on a global basis. Topics covered include Nomura's approach to sustainability and business initiatives to achieve specific SDGs; sustainable financing trends; political, economic, and regulatory trends in sustainability; and climate change and ESG risks.