Materiality

The financial system - the driving force of the economy - is essential in creating financial flows that help prevent environmental and social damage. We recognize that we play an important role as a leading global financial institution conducting securities and investment banking business. Through our core business, we will create a better future by addressing sustainability related issues, including combatting climate change.

These initiatives are in line with our "Founder's Principles" and our Purpose—We aspire to create a better world by harnessing the power of financial markets. They contribute to the sustainable development of society, our clients, and are important for maintaining and increasing our corporate value. Following the Nomura Group Materiality statement affirmed by our Sustainability Committee, we have and will continue to utilize our financial industry experience and knowledge in cooperation with our stakeholders to further promote relevant initiatives and realize a more sustainable and truly prosperous society.

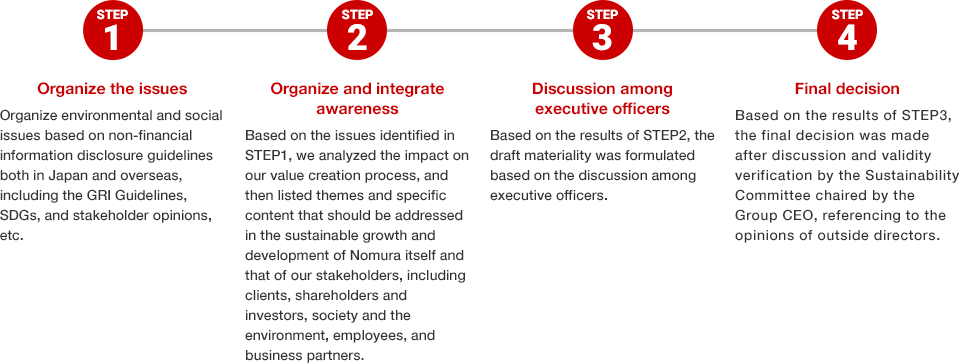

Selection Process

Material Issues

Since Nomura first identified CSR Materiality in 2008, we have regularly reviewed our materiality based on trends in the international community and the expectations of stakeholders. As establishing business models that take environmental and social issues into consideration becomes increasingly important, Nomura has been conscious of the relationship between sustainability and business strategy. Starting from FY2019/20, we renamed this "Nomura Group's Materiality" and have identified key issues to focus on by considering the external environment. We have identified materiality based on the following understanding of the external environment.

* Please scroll horizontally to look at table below.

| Our Awareness of the Environment Surrounding Us and Risks/Opportunities | Issues and details to work on | ||

|---|---|---|---|

| Changing global dynamics |

Awareness | The global situation continues to change rapidly and is difficult to predict due to trends in monetary policies and markets in various countries and heightened geopolitical risks. | Facilitating the circulation of sound risk money

We will facilitate the circulation of sound risk money through proposing and providing financial products and services that address changes in the global situation, market environment, and customers' situations and needs.

|

| Risk | If our risk management is inadequate or if we are unable to meet the needs of our clients, we may incur losses or lose revenue opportunities. | ||

| Opportunity | Appropriately capture changes in financial policies and investors' needs to increase revenue and expand business opportunities. | ||

| Threats regarding natural capital, including the environment |

Awareness | While responding to natural capital remains a global trend, the importance of balancing it with industrial policy is increasing. | Efforts to conserve natural capital

We will actively contribute to the conservation of natural capital through our own environmental activities our support for business structure and structural transformation initiatives.

|

| Risk | Credit risk of business partners, risk of market fluctuations, risk of physical damage due to disasters, reputational risk, etc. | ||

| Opportunity | Supply of risk capital necessary for mitigating and adapting to the crisis involving natural capital, including decarbonization (financial/capital markets, project finance, M&A, etc.) | ||

| Advancements in digital, AI technology, and threats |

Awareness | The utilization of digital and AI technologies, predicating on providing safety through ensuring security levels, is leading to changes in the economic structure. | Strategic and innovative service development with robust cybersecurity measures

We will work to enhance client convenience and expand our service domain by strengthening our digital strategy.

|

| Risk | There are risks of lost trading opportunities and reduced revenue due to the decrease in transaction fee levels from online trades, as well as a decrease in trust resulting from cybersecurity breaches. | ||

| Opportunity | Promotion of businesses related to digital assets through the utilization of digital technology and AI for streamlining operations, optimizing services, and improving efficiency. | ||

| Changes in the domestic environment in Japan, including declining birthrate and aging population |

Awareness | It is necessary to provide solutions that align with changes in clients' business activities and needs due to structural changes in society. | Providing solutions to social issues arising from environmental changes

We will identify changes in the domestic environment in Japan and provide solutions for problem-solving by leveraging Nomura Group's expertise.

|

| Risk | Failure to fully capture the changes in society such as the aging population, insufficient consideration for diversity, and inadequate provision of appropriate services leads to customer outflow and missed opportunities. | ||

| Opportunity | Creating new revenue opportunities by providing solutions that align with customers' business activities and needs. | ||

| Increase in awareness of DEI, human rights, and human capital |

Awareness | There is growing demand for establishing a healthy workplace environment, promoting diversity, equity, and inclusion, considering human rights in business, and utilizing human capital. | Creating an organization that supports challenges, rewards contributions, and provides a comfortable work environment

We are committed to realizing a society where human rights are respected, and diverse personnel can demonstrate their abilities.

|

| Risk | Incurring administrative penalties or paying compensation for damages due to overwork, reputational risk, decline in employee morale, stagnation in strategic execution due to talent outflow and inability to secure talent, and lack of adaptability to changes in the environment due to lack of diversity. | ||

| Opportunity | Enhancing competitiveness and increasing differentiation from other companies through diverse talent, promoting innovation, and realizing advanced risk management. | ||

| Demand for enhancement of governance |

Awareness | Demand for more sophisticated corporate governance and strengthening the function of the board of directors is increasing. | Further demonstration of corporate governance functions

We will work to improve our governance in order to be trusted by society.

|

| Risk | Governance dysfunction, reputation risk, etc., due to failure to demonstrate governance capabilities. | ||

| Opportunity | Improvement in corporate value due to further enhancement of risk management, cost reductions through structural reforms, and other initiatives. | ||